The previous article talked about the concept of international trade. This paper aims to explore more thoroughly the relationship between imports, exports, and debt and how it all connects with the IMF and World Bank.

Imports, Exports and Debt

What happens when people in a country want to buy more things than what is produced in that country? Well, they have to import those items. To pay for those imports, the country must sell assets or borrow. When goods and services are imported, money that was created or borrowed in the home country leaves, but the debt associated with that money remains.

A country that is a net importer (imports more than it exports) loses money. Additionally, it will still have debt associated with the creation of that lost money. This can harm the country’s economy. Some consumers might prefer goods from abroad instead of buying local products. Therefore, some local products do not get sold. As a result, the country loses buying power, and domestic sales suffer and the debt from the lost money still exists.

On the other hand, foreign currency is brought into the economy of country A when it sells items to country B. But, the debt behind that currency remains in country B. By exporting, money that was created through borrowing in another country is brought into the economy debt free. This money can be converted into local currency through foreign exchanges.

A net exporting country (exports more than it imports) gains from additional debt-free money in the national economy. This extra money boosts the economy as people have more money to spend, so they spend more. Consequently, there is more home and foreign trade in goods and services.

A net exporter means that the country is gaining money without accumulating debt. It indicates that its economy is strong and healthy. Nevertheless, the country loses its real wealth by selling physical assets. However, it is still profitable due to better sales of products and higher domestic purchasing power without relying on debt.

Balance of Payments

Each country in the world has a document called the balance of payments to record all international transactions. This accounting statement helps to depict how the movement of money and the movement of goods and services are interlinked. The balance of payments is divided into two parts: the current account and the financial account (or the capital account).

The current account acts as a record of what countries buy from and sell to other countries. The record also keeps track of the amount earned from investments, donations, foreign aid, and other transactions. For example, Kenya purchases ten billion dollars’ worth of computers from China and records the transaction in its current account.

This may be oversimplified, but when Americans buy products from China, the Chinese people have two options for what to do with that money. They can either purchase goods from the US or invest in US financial assets such as stocks and bonds. Such records of transactions are contained in the financial account part of the accounting records.

Exchange of Foreign Currency and International Trade

When money is converted from one currency to another internationally, it results in a shift of reserve currency from one country’s national bank to a foreign bank’s reserve account. Foreign banks have relationships with local banks that permit them to keep foreign reserve currencies without staying part of the central bank system. For instance, when exchanging one thousand pounds into euros, a UK bank will agree on an exchange rate with a European bank, let’s say 1.15 euros to the pound. The UK bank will then transfer one thousand pounds of the central bank currency to its UK partner, the Bank of the European Union. Likewise, the European bank will transfer 1150 euros of reserve currency to the European partner bank of the UK bank.

A country cannot use its foreign exchange reserves for spending within its borders. The funds can only be used in the home country for imports or investing in financial assets such as stocks and bonds, or they can be exchanged for another currency.

The Foreign Exchange (Forex or FX) Market and Speculation

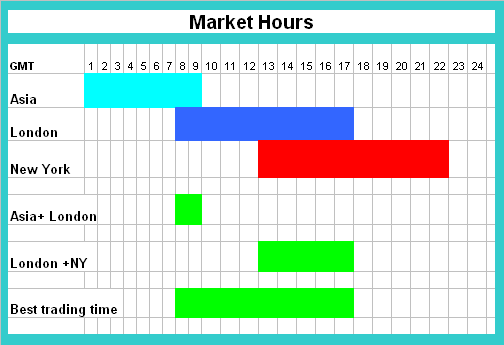

Different currencies fluctuate in value. This price variation, referred to as volatility, creates an opportunity for people to make money through speculation. Speculations are bets on whether the prices will go up or down. People can trade currencies at Foreign Exchange (Forex or FX) Markets, taking advantage of the constantly changing values.

Today, the most profitable way to make money is through speculation and currency trading, not the production of any tangible goods. It is making money from money. By far and away, it is the biggest and most profitable form of economic activity that exists in the world today.

Some people love unpredictable markets because they give them a chance to earn some money. They actively participate in trading and speculation to encourage volatility. The foreign exchange market has now become the largest and most liquid market in the world. As of April 2022, and on average, it transacted more than 7.5 trillion US dollars per day.

The World Bank, the International Monetary Fund (IMF), and Debt

These institutions were established in 1944 to promote global development. The World Bank developed a lending scheme to assist countries in post-war restoration, particularly those with limited resources, via loans. The IMF‘s objective was to establish an international reserve currency that can be found at any country’s disposal, regardless of the country’s wealth, in case of a balance of payments problem. These two institutions have largely replaced direct lending between countries. They have provided billions in loans to developing nations over the past 80 years.

No matter how rich a country seems, all nations are actually in debt and trade from a position of insolvency. This leads wealthy nations to rely on the developing world as a market for their goods. Developing nations are given loans with the condition that they make purchases from wealthy nations.

Tied Aid

‘Tied aid‘ is a kind of loan that sets up rules that guarantee that the countries that supply the loans will always have a market for their exports. Countries, especially developing nations, receive these loans on the condition that the money will be spent on specific nations (mainly those that issue the loans). What they spend is usually equivalent to the value of the loan advanced. However, when developing countries spend the borrowed money on imports, it goes back to the developed world. As a result the developing countries are left with a foreign debt that cannot be paid.

Where do the funds for these loans come from? The World Bank generates funds by issuing and selling bonds to banks on global money markets. The raised funds are provided at interest to countries in need of financial assistance. The IMF and World Bank are not simply loaning money; they also play a role in its creation.

Internal Debt Versus External Debt

When a well-off nation lends money to a developing country (tied aid), its economy gets a boost. This is because it creates a marketplace for its products and grows its money supply. However, the repayment of the debt is borne by the developing country. That debt can bring the whole economy of the developing country to a standstill and lead to widespread poverty.

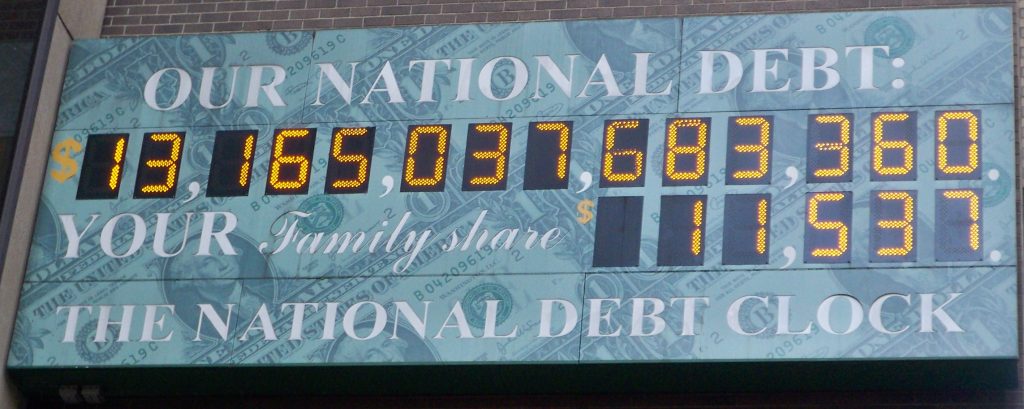

Any country is free to accumulate as much internal debt as it pleases since it is controlled by the government. Internal debt is the amount of money that a country borrows within its own borders. However, when it comes to external (international) debt it is not the same. External debt refers to the amount of money that a country owes to foreign lenders, such as commercial banks, governments, or international financial institutions. This debt grows quickly. It can leave an entire country under the financial control and mercy of entities and agencies outside its borders.

Wrath of External Debts

These debts have been used as a reason to acquire different assets. Private and public companies, pension funds, life insurance companies, and entire industrial sectors are some of the examples. Multiple developing countries have privatization programs, with more countries planning to implement them. As a consequence, the majority of domestic companies from developing countries are becoming foreign-owned.

This situation has turned developing nations into a financial mess and an economic disaster zone. This debt has let the wealthy countries, banks, and financial industry enjoy significant power, influence, and authority over the poorer parts of the world, which have valuable resources. Some individuals have likened this setup to a type of colonialism. It represents a tangible and direct means of control that has been utilized to compel these nations to act in ways that benefit the wealthiest sections of the globe. Consequently, corporations have reaped massive profits and grown immensely in size and reach.

Structural Adjustment Programs (SAPs) and International Trade

This is a set of economic recommendations offered by the IMF and/or the World Bank. They’re aimed at allowing the country to improve its debt situation. A country must adhere to these conditions for them to secure a loan from these bodies. These conditions typically include specific demands, such as:

1. Restructuring the Economy

Countries are urged to raise their exports to get more foreign exchange that can be used to settle their debts. Developing countries are often obliged to export their raw and unprocessed materials and crops to other nations. The former European colonies are required to produce raw materials and sell them to Europe at low prices. In the rural regions of Africa, farmers primarily produce chief slave crops such as coffee and black tea for export. Productivity is low, and poverty rates are extremely high in these regions. This economic setup is intentional. There will be no funds or grants from donors for the production of low-cost processing machines, equipment, or technology.

This approach repeatedly fails. Countries drastically reduce their government spending. As a result, they experience stagnation and no longer have growth opportunities. This reorganization leads them to neglect the growth of their economies. They end up allocating more money towards repaying debts rather than investing in areas like healthcare and education. Consequently, their debts continue to increase significantly. The nation eventually becomes a slave to big companies that plunder its natural resources and labor.

2. Limited Spending

Countries are instructed to reduce public sector spending. Further, they are advised to open up to free trade and financial market access to allow money to flow in and out more easily. The aim is to attract investments from the rich regions to resolve their economic challenges.

Once again, this situation does not benefit these countries. Instead, it harms the growing industries and abilities in these developing nations. These developing nations are solely dependent on the goods, services, and money of the more developed countries.

3. Reduced Taxes

The IMF tells these countries to lower the taxes for multinational corporations to attract more of them to operate within their borders. This may result in more corporations coming in. However, the profits they make leave the country quickly, without benefiting the nation. Due to the reduced taxes, several emerging countries do not create a tax base. As a result, such countries rely on international capital markets, money markets, and accumulating debt to operate. In the end, many countries all over the world have had to surrender their independent diplomacy to others. This is achieved when administrations disregard the requirements of citizens and succumb to pressure from institutions like the IMF, the World Bank, and financial markets.

Conclusion

By understanding the level of imports and exports, we are in a position to comprehend the whole range of complicated international trade. A major tool for demonstrating the interrelationships between monetary flows and trade procedures is the balance of payments. The World Bank and the International Monetary Fund play important roles in giving money to developing countries. Debts, both within a country and internationally, demonstrate the involvement of power dynamics. Programs like structural adjustment programs usually making economic problems worse for countries that need help. The complexities of global trade, currency exchange, and organizations like the World Bank and IMF emphasize the importance of having a detailed understanding of worldwide economic systems and how they affect countries.