In the previous article, we discussed the establishment of The Gold Standard. Gold and silver have served as the primary currencies for approximately five thousand years. However, it wasn’t until around 680 BC to 630 BC that they began to function as money. In Lydia, gold and silver were transformed into coins. These coins had the same size and weight, making them interchangeable. This quality is known as being fungible. This development allowed them to function as a unit of account and a standard of measurement. Goods or services were priced in terms of a certain number of these gold or silver coins. This price remained consistent for everyone purchasing that particular good or service.

Athenians and Money

Money found its natural environment in the free markets of Athens. It was the birthplace of democracy and civilization. The use of money flourished in Athens. It was the first society to implement a functional tax system and foster free markets. This newfound prosperity allowed Athens to excel and become a pinnacle of civilization. They were able to produce remarkable works of art. They reached unprecedented levels of architectural and engineering accomplishments that were unparalleled at the time. Even today, over 2,500 years later, the world continues to marvel at their achievements. It was an extraordinary era in human history. Athens stood as a prominent symbol of brilliance and success for many years.

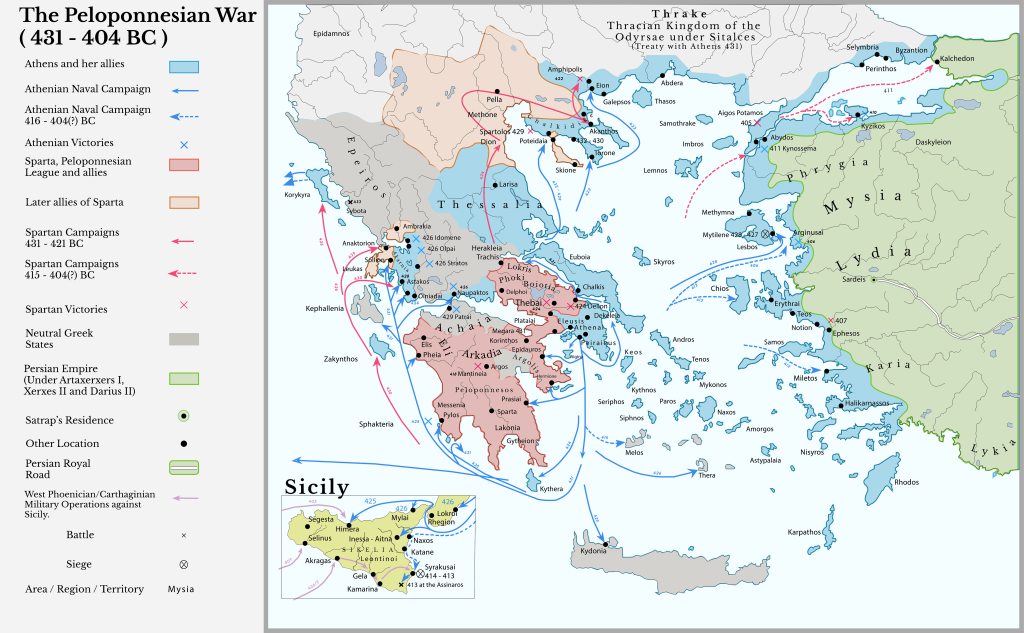

So, what went wrong? How did such a magnificent and influential civilization crumble? It was because of excessive greed and relentless warfare. This is a recurring pattern witnessed in history. The Athenians’ monetary troubles began during the Peloponnesian Wars. During the conflict with Sparta, the Athenians lost access to their valuable gold and silver mines. Moreover, they started paying armies with coins to obtain goods and services from local communities. This resulted in the outflow of funds from Athens. Consequently, Athens suffered from a deflationary crisis due to the constant drain of coins from the city. Subsequently, they resorted to debasing their coinage to finance the war efforts. They also engaged in deficit spending by minting more coins than they had assets to back.

Deficit Spending and Debasing Coinage

Deficit spending refers to the situation when the government spends more money than it collects through taxes or other sources.

Where does the government get this extra money to spend? They debase their currency. In ancient times, to finance wars, rulers would lower the value of their currency. They usually added cheaper metals like copper to their gold coins. By doing so, they could create more coins and raise more funds. People would take the new debased coins at face value of the original gold coin. The Athenians adopted this practice during their war with Sparta.

How the Athenians Applied Deficit Spending and Debasing Coinage

Athens continued to invest in expensive public projects. For example, the construction of the temple of Athena Nike. This was despite being involved in a long and costly war. At one time, there was atruce that lasted for six years. Instead of using this period to recover from the financial strain of the war, Athens continued their public works projects. As they debased their coins, people initially accepted the new coins at face value. Gradually, the value of the debased coins declined. The gold and silver coins became scarce. At this point, it took a significant number of copper coins to purchase just one gold or silver coin. This marked the first instance in history where gold and silver had a determined price. Previously, gold or silver coins were measured solely by weight.

Several factors caused the downfall of Athens. First, the costly wars they engaged in. Secondly, the empire they tried to expand. Thirdly, the devaluation of their currency, and the resulting inflation. They kept producing coins until they were practically worthless. This marked the world’s first ever hyperinflation, which severely weakened Athens financially. As a result, in 404 BC, they surrendered to Sparta and eventually became a subordinate state of Rome.

How History Keeps on Repeating Itself

It’s fascinating how history keeps repeating itself, without us ever learning from our foolish mistakes. We continuously make the same errors, over and over again. Presently, we are following the same path as the Athenians, resulting in the decline of their magnificent culture. We’re devaluing our currency, spending more than we have, and for the same reasons: war and extravagant public projects. Our financial system essentially takes wealth from the less fortunate and the middle class. It in turn shifts that wealth to financial institutions like the banks. This pattern of events has occurred repeatedly throughout history.

The Global Monetary Systems

1. The Classical Gold Standard

The true international gold standard only lasted for a short period of time, from 1871 to 1914. An equivalent amount of gold in the United States Treasury, backed each unit of currency. During this period, if you had currency (which was basically a receipt for money), you could go to any bank and exchange it for actual gold. One ounce of gold was equal to $20.67. The bank was required to give a person a $20 gold coin, if they wished to exchange it for a bank’s $20 bill or cash a $20 check. This obligation ensured that all bank-issued money holds its value in gold.

This system instilled trust in the currency and allowed governments to store gold in their vaults and print currency backed by that gold. This trust also allowed governments to engage in a practice where they print more receipts for gold than the actual gold reserves. This practice became more common. This was due to the suspension of redemption rights during World War I. During this time, individuals could no longer exchange their pounds, lira, marks, or francs for gold.

2. The Gold Exchange Standard

It lasted during the period between World War I and II. It was a lesser version of the gold standard. Gold would partially back these currencies. This system supported currencies with a certain amount of gold. $20 worth of gold backed a $50 claim check. This meant that there was a reserve ratio of 40%. For every $40 gold piece in their vault, they were able to circulate $100. In the United States, under the Federal Reserve Act of 1913, the Federal Reserve had the authority to issue claim checks on gold currency in circulation.

In both wars, Europe had to import large quantities of consumer goods, grains, and weapons from the United States. They paid the US with gold. As a result, the American national income grew significantly, reaching $142 billion in 1943. That amount was double the figure from 1939 and triple the figure from 1933. This phenomenon led to the myth among Americans that war is beneficial for the economy. That myth could be seen as true if you are not directly involved in the war. Also, if you are selling the necessary tools and supplies to those who are in war,

3. Bretton Woods System

After World War II, the United States held vast gold reserves, accounting for two-thirds of the world’s monetary gold. Meanwhile, the rest of the world had to share the remaining one-third, and Europe had no gold reserves at all and faced economic crises post-war. The devastation caused by the war had led to financial difficulties for countries, as they lacked the necessary gold to support trade, print currencies, and generate income. Therefore, the global financial system was no longer functional and would eventually fail.

To address this, representatives from different countries gathered in 1944 at Bretton Woods, New Hampshire, for a meeting called the Bretton Woods Conference. Their objective was to establish a new global financial system. The United States and the United Kingdom collaborated to govern the global economy and established institutions like the International Monetary Fund (IMF), the International Bank for Reconstruction and Development (IBRD), and other organizations to manage the international currency. The IBRD’s role was to assist war-torn countries in rebuilding and stabilizing their economies. This institution is now known as the World Bank. The IMF’s purpose is to facilitate trade between nations, and it still provides support to countries facing economic challenges today.

Outcome of the Bretton Woods Conference

During this meeting, the US Dollar was to be used for trade by countries without gold. The US had a substantial amount of gold. This allowed it to distribute its value worldwide. The US also announced that anyone could exchange gold for US Dollars or vice versa. This system pegged currencies to the US dollar. This meant that the US dollar would support most of the world’s currencies. Gold would in turn back the UD Dollar at a rate of $35 per ounce. This arrangement ensured that virtually all currencies were essentially backed by gold.

Countries could exchange their currencies for US dollars and then convert them into gold, providing stability and linking all currencies through the US dollar to gold. This is how the US dollar gained its status as the world’s reserve currency. There was no foreign exchange market at that time, as currencies had fixed exchange rates and did not fluctuate. This stability contributed to the growth of international trade.

4. The Dollar Standard

During the Bretton Woods system, there was no rule that required the US to have a certain amount of gold for every dollar created. Unfortunately, greed and war often ruin financial systems. As a result, the US engaged in extensive deficit spending to fund the Korean and Vietnam wars, as well as Lyndon Johnson’s Great Society program. The supply of paper dollars in circulation increased. They were then exported worldwide. Consequently, the US neglected its responsibility of governing the monetary system. It ended up inflating the value of its currency which was supposed to be linked to gold and other currencies.

On the contrary, the economies of other countries also improved. In 1965, Charles DeGaulle, the President of France, became worried about the United States spending more money than it had in gold reserves. He recognized that the US did not have sufficient gold to support the value of its dollars. France took immediate action and requested the return of their gold. As a result, other countries observed this and followed suit. This led to a massive global bank run, causing the US to lose 50% of its gold between 1959 and 1971.

5. Introduction of Fiat Currency

Consequently, President Nixon was compelled to remove the US from the gold standard. Gold could no longer be exchanged for dollars or vice versa. Otherwise, the US would have had to continue to exchange gold until it was depleted. As a result, the entire worldwide monetary system would have collapsed. This was because the government would have been unable to fulfill all the outstanding dollar obligations. On August 15th, 1971, all currencies around the world became fiat currency, marking the end of the Bretton Woods system and the beginning of the modern era of the financial system.

The petrodollar was introduced to ensure that the currency remained reliable. There was an agreement made in 1974 between the United States and Saudi Arabia. It stated that all global oil trade would only be conducted using US dollars. Every country was obligated to hold some Dollars in reserve as they required oil. This agreement effectively prolonged the dominance of the US dollar as the primary currency for international trade for many years to follow. Currently, 180 different currencies are being used worldwide. The US dollar comprises more than half of all the currency in circulation. In the upcoming article, we will explore the topic of generating money and government debt.

Conclusion

The history of Athens is a cautionary tale about the dangers of unchecked greed and endless wars. The debasement of currency, excessive deficit spending, and inflation led to the downfall of a once-magnificent civilization. There is a need to learn from past mistakes since similar patterns have been seen throughout history. To navigate today’s financial landscape, it’s essential to understand the transition of monetary systems, from the gold standard to the current fiat currency. Our next article will explore how creation of money is related to government debt.