Central banks can generate a virtual currency called central bank reserves. Banks can use these reserves to transfer payments to one another. It is just like a digital currency that most banks prefer rather than simply using physical currency and notes. Banks transfer this electronic money amongst each other to complete transactions. They prefer this method since carrying large amounts of cash can be risky, inconvenient, and costly to handle. The Central Bank stores this electronic money for the banks. A member of the public cannot use this electronic money. You are not eligible to have such an account with the Central Banks. When a commercial bank has a bond (which is essentially a government debt), it sells it to the Central Bank. In return, the central bank adds new numbers to the bank’s account. By doing so, they effectively create central bank reserves out of thin air.

Intraday Clearing

When customers of a bank make payments from their account to someone else’s account, this triggers the intraday clearing process. Thus, in this process, the amount of central reserve currency held by bank A at the central bank decreases by the same magnitude that bank B gets. This highlights the significance of central reserve currency for banks. In the past, banks had fewer reserves for the Central Bank to cover their commitments to other banks. Consequently, they had to borrow from other banks and pay interest rates.

If you sell something online, the transaction is not finished until the money is deposited into your account. Most people want to see the money in their account before finalizing a deal. This is similar to how banks operate. They also require the money to be in their account at the central bank before considering a transaction complete.

Let’s assume that you were buying a home from someone who uses a different bank. In this case, you would need to direct your bank to transfer money to the seller’bank. Consequent to this, the bank will inform the Central Bank to debit the specified amount from its account and credit it to the seller’s bank account. This transfer takes place within the Central Bank. Once the money has been successfully transferred, the banks consider the payment settled. They don’t handle the same kind of money that we have in our accounts. Instead, they use specialized money that can only be used at the central bank, the central bank reserves.

The Velocity of Currency

This refers to how often money is used in transactions. There are tens of millions of people around the nation sending and receiving money through only a few big banks. They hold a sizeable portion of all the deposits. These banks track each of these transactions from their computer networks. The majority of these transactions end up canceling each other out. There are a limited number of banks in the system handling the majority of the currency. Therefore, the central reserve money only moves from one bank to another in a closed loop. This means that the money just circulates through the system repeatedly. If you think about it, a one-pound coin, if circulated a billion times, could make a billion pounds worth of payments. That’s essentially the system we have now.

We will use two scenarios to explain this concept.

Scenario 1: Currency Circulates in a Closed Loop

Let’s imagine that I have traveled to a new town and found a nice hotel to stay in for the night. I pay Kshs. 3,000 for the hotel room. After paying, I proceeded to inspect the hotel and its surroundings. The receptionist, who received my money, then used the Kshs. 3,000 to pay for some meat that he bought from a nearby butcher. The butcher, in turn, rushes to pay Kshs. 3,000 to the slaughterhouse for the meat he had received from the slaughterhouse. The person who sold the meat to the butcher hurries to pay a farmer Kshs. 3,000 as a balance owed for a goat that he slaughtered.

The farmer, now having enough money, pays off his debt of Kshs. 3,000 to his friend, a veterinarian, for attending to his animals. The veterinarian then uses Kshs. 3,000 to pay for some food he had eaten at the hotel where I’m staying. I was dissatisfied with the hotel after my inspection, and I asked the receptionist to refund my Kshs. 3,000. The example demonstrates how the system circulates currency in a closed loop, which in turn creates a false perception of value. My Kshs. 3,000 facilitated transactions worth Kshs. 24,000 in total, involving eight different exchanges.

The way this system operates is by having a limited amount of actual money continuously circulating within the system. We use these funds to cover a huge variety of payments.

Scenario 2: Currency Circulation and Inflation

Let’s imagine a country with only ten people and an economy that consists of just these ten people. In this country, there is only one dollar in circulation. This one dollar moves around only once; consequently, the GDP (the overall economic status) will be only one dollar. If it circulates twice, it becomes two dollars. So, one dollar multiplied by a velocity of ten transactions equals a GDP of ten dollars.

Now, let us increase the amount of money in supply and give each person $1. If each person spends their dollar, then there will be ten transactions. So, ten dollars multiplied by the speed at which money changes hands gives you the gross domestic product (GDP). In this scenario, each dollar was involved in only one transaction, totaling an economy of ten dollars. Thus, ten dollars multiplied by one transaction equals ten dollars of GDP.

Consequently, even if you multiply the existing money supply tenfold and there is no change in economic activity, the economy remains the same. There are still ten transactions, resulting in a GDP of ten dollars. However, when the economy experiences more transactions, such as a second, third, or fourth one, then that might be an indication of a healthy economy. However, in a struggling economy, it could also result in hyperinflation.

High currency velocity has the potential to cause hyperinflation as well as inflation. Psychology (that understands the principle of patterns and cycles from a behavioral aspect and attitudes toward money) is a factor that affects how fast money moves.

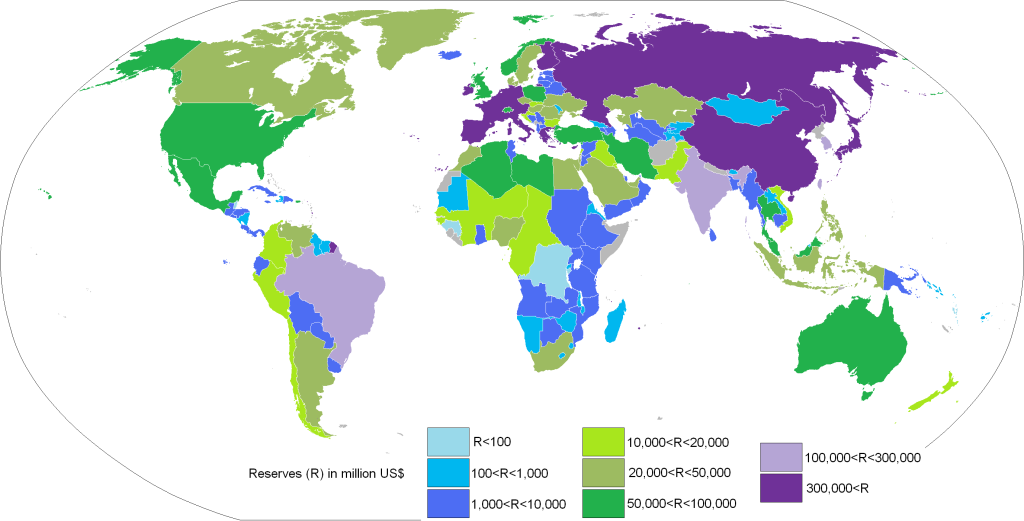

Foreign Exchange Reserves

These are the assets that a nation’s central bank possesses. They are composed of government securities, bonds, foreign currencies, and Treasury bills. Economists advise holding foreign exchange reserves in a reserve currency. The reserve currency should not be strongly tied to the nation’s currency, ideally.

Reserve Currency

They are highly accepted foreign currencies that are held by central banks and other financial institutions in large amounts as part of their nation’s foreign exchange reserves. They are primarily used for international trade and investment transactions. The US dollar is currently the world’s most valuable reserve currency. The US dollar is the most commonly used reserve currency due to its widespread use in international trade. The British Pound (GBP), the Euro (EUR), the Chinese Yuan (CNY), and the Japanese Yen (JPY) are examples of the other reserve currencies. Commodities such as oil and gold, as well as financial assets, are priced in the reserve currency. This means that to buy these goods, you need to have this currency.

Central banks use reserve currencies to make international debt payments and have a say in local exchange rates. Holding reserve currencies benefits countries since they won’t have to exchange their currency for the reserve currency when making purchases. These reserves also assist countries in managing economic crises and downturns. For example, the central bank of a country can use this foreign reserve to maintain the value of the currency that has depreciated during a recession.

The Requirements for Reserve Currency Status

A reserve currency should be easily exchangeable (converted to other currencies) and have a stable and steady value. As a consequence, several reasons are responsible for a country’s currency being named as a reserve currency. These reasons include the size and strength of the country’s economy, its participation in international trade, the condition of its financial markets, and the macroeconomic policies of the nation, among others.

The US dollar has been the world’s main reserve currency since 1944. This implies that other nations closely monitor US monetary policy. This is to safeguard the value of their reserves against price increases or inflation. With time, other new currencies have been added to the basket of reserve currencies. They include the Australian dollar, Canadian dollar, Swiss franc, Euro, Chinese Yuan, Japanese Yen, and Pound Sterling. In the years to come, there are expectations that other currencies will give a tough fight to the dollar. They might stake their claim as the primary reserve currency.

With more than $3 trillion in assets, mostly in US dollars, China has the largest foreign exchange reserves in the world. As of March 25, 2022, the United States had $247 billion worth of foreign exchange reserves. The US reserves are much smaller than China’s.

Conclusion

Central bank reserves are a digital currency that banks use to make payment transactions. They are essential to the smooth operation of the banking system. Central banks create the reserves, which facilitate same-day clearing between commercial banks.

To have a good understanding of the mechanisms of the financial system, you need to have a thorough knowledge of how money is circulated and maintained within a closed loop. Furthermore, central banks’ foreign exchange reserves are critical factors in terms of overcoming economic problems and keeping national currencies stable. They are normally held in major currencies such as the US dollar. A reserve currency is chosen as a result of multiple factors. The importance of central bank reserves and reserve currencies continues to influence the global financial scene as economies become more interconnected globally. We will study Forex, international trade, and the IMF in the upcoming article.