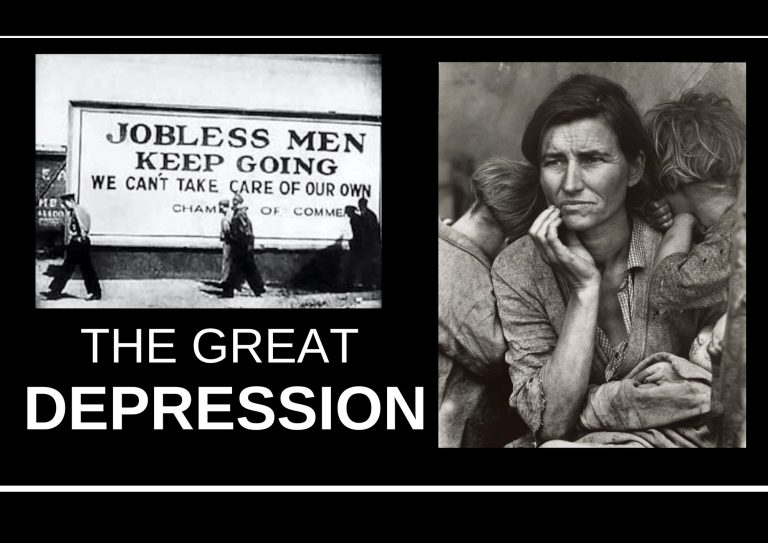

The Great Depression was a worldwide disaster, with millions of people falling into poverty. In America, many people waited in line for bread and lived in makeshift housing. In Germany, the impact of the Great Depression paved the way for Hitler and eventually led to the beginning of World War Two.

The Roaring 20s

During World War One, farmers took out loans to buy machinery like tractors and harvesters. They also increased the size of their farms. This led to a significant increase in crop yields. This war came to an end after four years of conflict. America was on the winning side and had fewer casualties compared to other countries. The soldiers returned home and could now work in these factories to produce non-war items, such as recreational products. The rise in factories also led to an increase in employment opportunities. Henry Ford’s development of the assembly line helped boost this production quickly. Projects that were put on hold are now being worked on. Now, there were more people with money to spend.

The US was receiving a lot of money from European debtors after the war. It had been supplying Europe with food, weapons, and ammunition. So, it had plenty of money and supplies. Taxes were lowered multiple times to encourage people to spend more. This led to higher wages and an increase in consumerism. This made banks offer loans to a wider range of people, enabling more people to buy the newest and best gadgets on the market.

Easy loans and installment buying fueled the economic boom of the 1920s. Businesses borrow money to grow and expand. Families borrowed money to purchase new household items and make home improvements. Inventions such as the radio, vacuum cleaner, and washing machine were in high demand. People were able to afford more luxury items than ever before, earning the era the name “Roaring Twenties.” It was a time of great economic success.

Soon, everyone was getting the car—Henry Ford’s Model T. Henry Ford allowed people to purchase the Model T in installments, which greatly increased the sales of cars. The increase in car sales had a significant positive impact on the American economy. It benefited industries like steel, glass, petroleum, and rubber. Consequently, this increase created new jobs in factories and the building of roads and gas stations. Because more and more people were able to buy the Model T, they traveled longer distances for work.

The stock market

All these activities were making companies very rich. At the same time, the average American saw their wealth grow. They started to look for things to do with their newfound wealth. Many decided to try their luck by investing in the stock market, hoping to make even more money. It was easy for investors to make profits. The stock market became very popular. A lot more people started buying and selling stocks. Soon, everyone, from cooks to taxi drivers, was trading stocks like experts, putting all their savings into whatever seemed promising that day. Some even took out loans to invest more. Banks also wanted to invest more money and resorted to using customer deposits to buy stocks. In reality, America was full of risky loans.

The economy had been slowing down, at least since the mid-1920s. But it went unnoticed because things were going well in America overall. People were making a lot of money from the markets. By 1929, America’s wealth had doubled, and investments had risen by 218 percent since 1922. In fact, stocks were rising so fast that companies were having a hard time keeping up and justifying their stock price.

The First World War and the rise of The Great Depression

1. Austerity Measures

The war caused a global economic disaster because of the debts and reparations it created. For example, Germany had to pay $33 billion in reparations to France and Britain under the Versailles Treaty. However, Germany had to borrow money from American banks to make these payments. Moreover, Britain and France owed the U.S. $10 billion, some of which was paid back with German reparations.

The global economy started slowing down in the mid-1920s. The European market had shrunk due to the austerity caused by World War One. Despite the U.S. doing well because of the war, they reached a point where they couldn’t sell any more goods without a thriving global market. Many countries couldn’t afford luxury items, and global trade had come to a halt.

2. Reduced Agricultural Activities

Farming in the US had slowed down as well. Agriculture had grown significantly during the First World War to feed the soldiers. Buying machines to industrialize farms was costly. Demand for agricultural produce fell sharply once the war ended. This led to many farmers getting into debt and farm workers losing their jobs. By the mid-1920s, many farmers were struggling to pay their bills. So many farmers took out loans to expand. Although crop yields were high, the domestic market was oversaturated, and there was little room for growth overseas. With overproduction and low prices, many farms went out of business. About a third of Americans were still employed in agriculture during this time, so the collapse of the industry would have a huge impact.

3. Reduced production in factories

Production at the factories began to slow down. Henry’s company was producing fewer model T’s than previously, and consumer demand was declining. It looked like companies may have overestimated their growth. Wages started to drop, and interest rates were on the rise.

The stock market continued to rise, despite concerns about the economy. Investors were more or less ignoring these problems and were buying stocks as if everything was going well. Soon, some people in the stock market started to notice these changes, but overall, things remained positive and people were gambling with their investments. However, the warning signs were becoming more apparent, and investor uncertainty was on the rise. It became clear that the soaring stock prices were not backed by any solid foundation. The strong economy driven by speculation in the stock market was an illusion.

Black Thursday

In the late 1920s, the overproduction of wheat caused stock prices in that industry to decrease significantly. Other markets also had too many of their products, creating more surplus than usual. This caused people to begin to lose trust in the market. People started to see that stock prices were unrealistically high. So, they began to sell their stocks. This led to a chain reaction for others as well.

October 24th, 1929, known as Black Thursday, is the theorized start of the Great Depression. Investors began selling as soon as the markets opened. People didn’t even know what they were selling. This led to a dramatic crash in the stock market. In just one day, over 12.9 million shares were traded. This massive selling spree resulted in significant losses to America’s wealth as the stock market plummeted. However, the markets recovered later that day.

Black Tuesday

On this day, October 29, 1929, the markets rebounded and lost forty million dollars in just one day. Panic spread throughout the market. Stocks became worthless. Many people lost all their savings, and those who borrowed money to invest were crushed. The market crash made it clear that a new era of economic hardship had started. People lost faith in the economy and became reluctant to spend money. Shareholders were directly impacted by the initial effects of the depression.

The Great Depression

It began towards the end of 1929 and lasted up to 1941. It was a period of severe economic hardship in the United States and worldwide.

At first glance, it seemed that the stock market crash only affected stockbrokers and the wealthy. But its effects actually reached even the general public. Businesses suffered financial losses and were unable to pay their employees. Additionally, banks stopped giving out loans. This resulted in a freeze in credit. The frozen credit system caused a decrease in the circulation of money, leading to deflation.

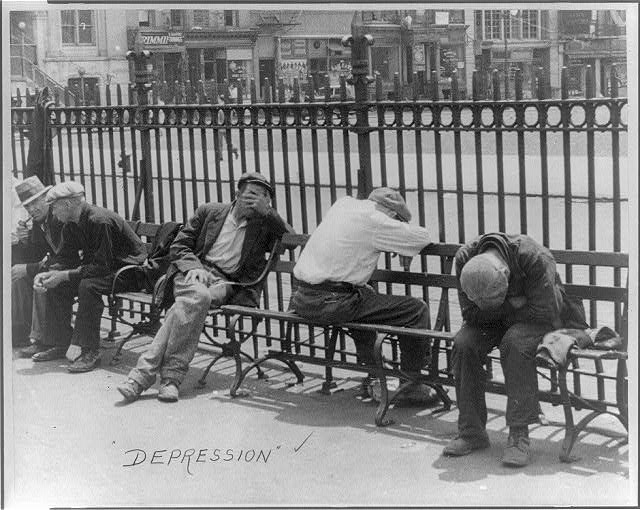

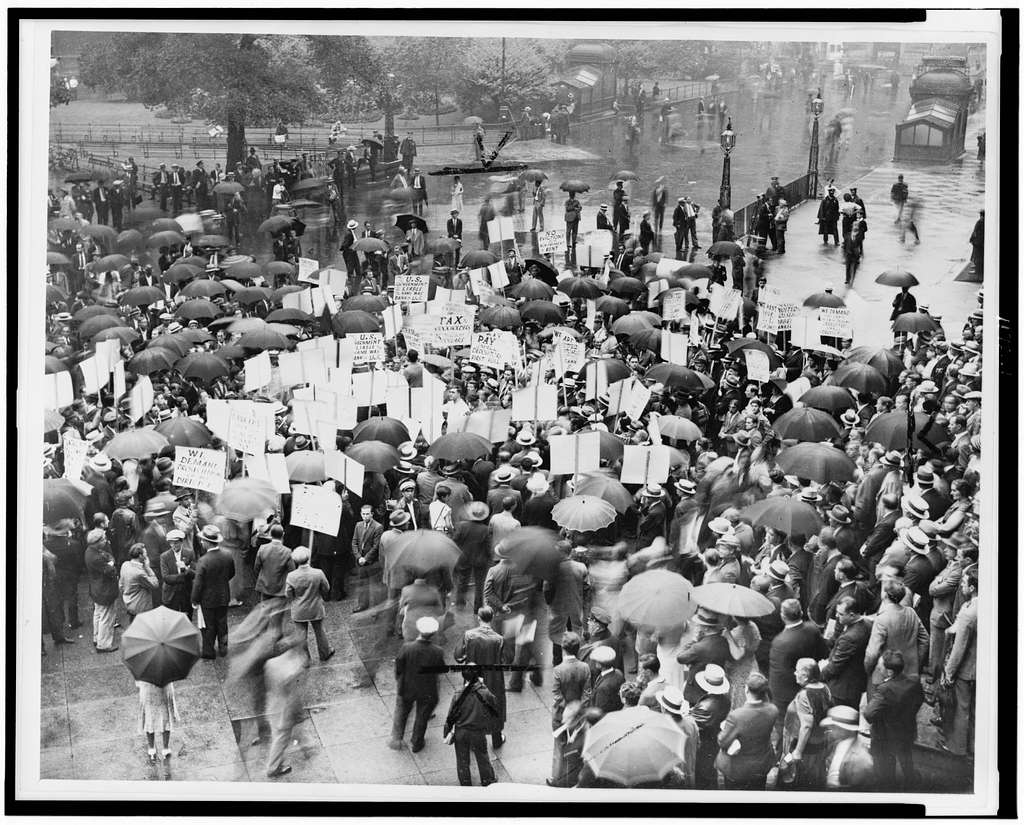

Deflation caused more harm than inflation. The reduced money supply led to a chain reaction of reduced spending, reduced demand for goods, and eventual low prices. As prices dropped and because employers couldn’t borrow money to pay their employees, businesses started cutting costs by lowering wages and laying off workers. These unemployed people had less money to spend on products from other businesses, causing a ripple effect. This led to a decrease in profits for businesses, forcing them to further cut wages or let go of more employees. Consequently, many businesses went bankrupt, causing the industry to come to a standstill. By early 1932, over 10 million people were unemployed, which was about 20% of the workforce. This vicious cycle ultimately resulted in a 25% unemployment rate and ongoing poverty.

Between 1930 and 1933, there was a series of bank failures due to a lack of investor confidence in the economy. Smaller banks in all parts of the United States did not have adequate funds to handle the sudden demand for cash withdrawals. As a result, numerous banks had to shut down, leading to bankruptcies for many individuals. People who had borrowed money to invest in stocks were left with nothing. Tragically, some stockbrokers even took their own lives.

The effects of the Great Depression

Many ordinary Americans waited in long lines to receive food. Homelessness was widespread. Others became hobos, traveling around to look for jobs wherever they could find them. The rest were hungry on the streets as farmers couldn’t afford to harvest their crops, leaving them to rot in the fields. Shanty towns grew across the country. Whether you had investments, took out loans, or simply kept money in a bank, the depression found a way to hurt you.

Times were financially difficult during the 1930s, and Franklin D. Roosevelt’s attempts to help did not have much impact. The effects of the Great Depression were felt around the world due to increased globalization. With economic despair, Hitler rose to power in Germany by exploiting the German people’s suffering, which led to the establishment of the Nazi Party. It wasn’t until the Third Reich rose in Germany that the crisis began to improve.

The Second World War and the end of The Great Depression

The war began in 1939, ironically ending one tragedy with the start of another. This war was not fought on American soil. Therefore, America was a source of supply for the needs of the war in Europe, and this meant job creation. There was a shift from price wars to government contracts with fixed prices. This ensured that no one incurred losses, and instead, production benefited both the government and contractors. Factory work became crucial, and there was a surplus of job opportunities available.

With more jobs available, there was increased spending on products sold by businesses, leading to more profits for businesses and the creation of even more jobs. The new employees had money to buy products from other businesses. This cycle ultimately helped end the Great Depression. The economic troubles soon transformed into a booming era of consumerism in post-war America. After a decade of economic hardship, it took the largest conflict of the 20th century to restore economic stability.

Conclusion

Excessive debt was the main cause of the Great Depression. The prosperous appearance of the Roaring Twenties was mainly a facade. During this time, there was a widespread promotion of credit. Many people used loans to buy things and invest in the stock market. Businesses also borrowed money to invest in stocks. Banks use their customer deposits to buy stocks. However, many people borrowed more money than they could afford to pay back. This led to banks running out of money. Speculation, greed, and market fear were other factors that showed the destructive power of markets when uncontrolled. The stock market crashed, causing the most severe economic crisis of the 1930s. Ironically, the Great Depression came to an end with the beginning of World War 2.