In the last discussion, we covered how central banks evolved as a way to address the issues that arise when using paper money in an economy. However, to gain trust in the concept of using paper money, many individuals felt that another measure was needed. Hence, there was the implementation of the Gold Standard.

What is The Gold Standard

A gold standard is a monetary system where the value of the currency is based on a certain amount of gold. Paper currency was supported or backed by gold. A country’s currency had a value directly linked to the value of gold. This means that at any given moment, you could exchange your paper currency for a specified amount of gold. In the Gold Standard monetary system, the value of the currency remained fixed and did not fluctuate. It stayed constant in relation to a benchmark.

For example, the U.S. dollar used to be defined as just under 1/20 of an ounce of gold. This meant that one ounce of gold was equal to $20.67. Similarly, a silver standard was also based on a certain amount of silver. The pound sterling in Britain originally represented one pound of sterling silver.

Thanks to banks, a gold standard no longer required people to carry bags of gold coins. Instead, paper currency was used for convenience. However, if someone wished to exchange a bank’s $20 bill or cash a $20 check, the bank was required to give them a $20 gold coin. This obligation ensured that all bank-issued money held its value in gold. Throughout history, the purchasing power of gold has remained consistently stable.

A Gold Standard Love Affair Lasting 5,000 Years

Gold’s enduring allure spans over 5,000 years, marked by its unique properties and influence on supply and demand dynamics. From its early use in religious rituals to its contemporary popularity in jewelry making. Gold’s appeal has remained unmatched among metals. In the beginning, people used gold only for worship. The inception of gold coins came later around 700 B.C. It further enhanced its utility as a medium of exchange. Prior to this development, gold had to be weighed and examined for purity when used in trade transactions.

Genesis of the Gold Standard

The gold standard was established in the United Kingdom in 1821. It marked a transition from silver to gold as the primary global monetary metal. In other countries, a mixture of gold and silver was used until the 1870s. This was when Germany, France, and the United States switched to a gold standard. Many other countries followed suit. This change was driven by the discovery of gold in western North America, which made it more abundant. Under the full gold standard that lasted until 1914. Gold could be bought or sold at a fixed price in exchange for paper money.

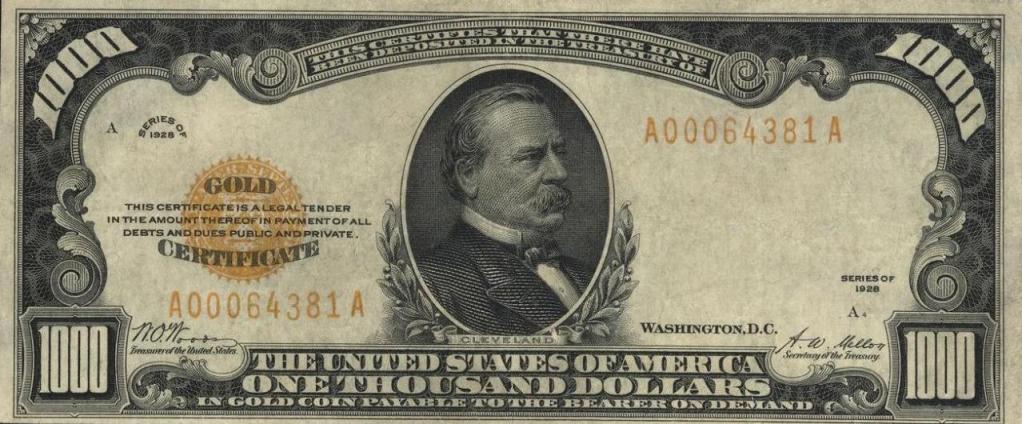

During this time, every paper currency note issued by the Treasury would say that, “there has been deposited with the United States Treasury – 20 dollars in gold coin payable to the bearer upon demand.” The actual money (gold) was kept in a vault. When you received a currency note, it was like getting a claim check for that money. It was similar to when you give your shirt to a dry cleaner, and they give you a claim cheque in return. The value was in the shirt itself, not the piece of paper saying you own it. So the U.S. Dollars that were in circulation were essentially claim cheques for the actual money.

The full gold standard was only in effect for a short time, from the 1870s until World War I started. During the war, many countries used paper money that couldn’t be converted into gold or restricted the export of gold.

Gold Exchange Standard

By 1928, after WW1, most nations had returned to using the gold standard, although they didn’t have enough gold. So, they adopted a gold-exchange standard. They used currencies like U.S. dollars and British pounds, which were convertible into gold at a fixed exchange rate. However, during the Great Depression in the 1930s, this gold-exchange standard failed again.

By 1937, no country was using the gold standard. In the postwar period, most countries’ exchange rates were then either tied to the U.S. dollar or to gold. The United States set a new minimum dollar price for gold. Foreign central banks had to use a new minimum dollar price when buying and selling gold. They could exchange dollar assets for gold at the official rate of $35 per ounce. This action, known as “pegging” the price of gold, helped establish an international gold standard after World War II.

By 1958, a form of gold standard had been reinstated. It allowed major European nations to freely convert their currencies into gold and dollars for international transactions. However, in 1971, the United States stopped the free conversion of dollars into gold at set exchange rates for international transactions. This was due to decreasing gold reserves and a growing deficit in its balance of payments. From then on, the international monetary system was based on paper currencies like the dollar. This marked the end of gold’s official role in global exchange.

Issues Addressed by the Gold Standard

Firstly, it prevents inflation by restricting governments and banks from manipulating the money supply through excessive currency issuance. There would be a balance between the paper currency and the gold that they could redeem. This control is essential to prevent devaluation of currency values and maintain economic stability. Printing more bills reduces the value of each bill. This devaluation is a problem for people who have their savings in paper bills and for other countries who accept those bills in trade.

Secondly, it stabilizes prices and foreign exchange rates, facilitating international trade by providing a common standard of value. For example, during the time when paper money was becoming widely used in Europe, international trade was growing rapidly. The Industrial Revolution was in full swing. It resulted in an increased need to ship and trade raw materials and finished goods. However, a problem arose when a ship carrying cargo arrived at a foreign port. The merchants on both sides had different currencies and didn’t know how to exchange them. You would hand the local merchant your funny green paper money to buy their goods. On the other hand, they would hand you their funny pink paper money to buy what you were selling. If both currencies were tied to the Gold Standard, this issue would be resolved.

To illustrate, imagine if you could exchange 20 US dollars for one ounce of gold. Now, let’s say you travel to England where they have set their gold standard in a way that one ounce of gold is worth ten British pounds. This simplifies things. Since both countries operate on the Gold Standard, it means that one British pound is equal in value to two US dollars.

Drawbacks of the Gold Standard

Under the gold standard, there are a few. One is that the supply of gold does not increase as quickly as its demand. Therefore, it is not adaptable during difficult economic situations. Furthermore, mining for gold is expensive and has detrimental effects on the environment.

Current Status

At present, no country uses the gold standard anymore, but some nations still have large amounts of gold reserves. After the gold standard ended, fiat currency became the preferred alternative. The true international gold standard only lasted for a short period of time, from 1871 to 1914. Later, a lesser version of the gold standard persisted until 1971. However, its decline began many centuries earlier with the introduction of paper money, which offered greater financial flexibility. Nowadays, the value of gold is determined by market demand. Even though it is no longer a standard, it remains a crucial asset for countries and central banks. Gold is used as a financial reserve, a hedge against government loans by banks and as a gauge for economic health.

Within a free-market framework, gold functions as a currency alongside the Euro, Yen, or U.S. dollar. Considering gold as a form of currency and trading it accordingly can help reduce risks like inflation compared to paper money. When there is instability in the market, people often discuss the idea of establishing another gold standard.

Conclusion

The Gold Standard was a monetary system where currency values were fixed to a specific amount of gold. This system provided stability and trust in the economy. The impact of the Gold Standard era on global finance was significant even though it was short-lived. The subsequent adoption of fiat currency marked a shift away from gold-backed systems. However, gold is still a valuable asset for central banks and investors. Despite no longer being in use, the historical legacy of the Gold Standard continues to influence discussions on monetary policy and financial stability worldwide. In the upcoming article, we will explore how the Gold Standard was abandoned, and a fiat currency system was established.