The dot-com bubble is a stock market bubble that revolved around speculative investments in dotcom or internet-based companies. This bubble started in 1995 and burst five years later, in 2000. Investors were so excited about the progress of the internet that they invested in pretty much any tech company with a “.com” domain on their internet address.

In the early 1990s, the internet was just like any other new industry. It was a revolutionary technology that had come onto the scene. People got very interested in it. They saw the money-making potential, and they wanted to get involved. Like with any other industry, there is a thing called overinvestment. Overinvestment inflates the prices in the industry, making everything more expensive, which only drives the prices even higher and higher. But when it turns out that all of this investment isn’t generating any profit, well, you get the dot-com bubble. It burst, bankrupting most and making billionaires of a select few.

Dot-com Bubble: The Key Moments

1. Low interest rates

The United States Federal Reserve decided to lower interest rates to increase borrowing and spending of money and, in turn, encourage economic growth. So, thanks to this and capital gains tax cuts, things were much cheaper. This meant investors had more money to invest. And the more excess cash people have, the more likely they are to make risky investments. But the question was, what were they going to invest in?

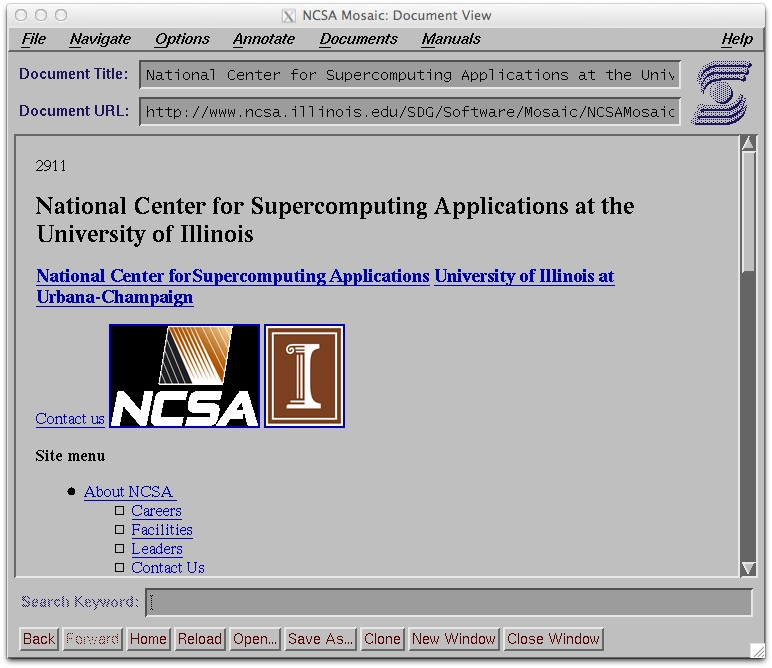

2. The Internet and Mosaic Internet browser

Computers were very impactful. but it wasn’t until we started connecting them and exchanging information all over the world that the social impact went through the roof.

The internet wasn’t very user-friendly in the early 1990s. You needed a lot more computer skills back then compared to now. So, there was barely anyone on it. But this would all change with the rollout of a new internet browser called Mosaic. It was one of the first widely available browsers. The browser was released in January 1993. It was the first user-friendly home internet browser that showed pictures alongside text. It helped bring wide access to the web and was key to popularizing the internet. A lot more people are now starting to use the internet.

The growth of the internet and its general popularity started snowballing. computers and the internet became more accessible. More websites were being made. With the internet in its infancy, there’s a lot of untapped potential. The Internet was growing very fast, and millions of new Internet users meant millions of potential customers for online businesses. As you can imagine, plenty of internet-based companies within the I.T. sector started to expand very quickly.

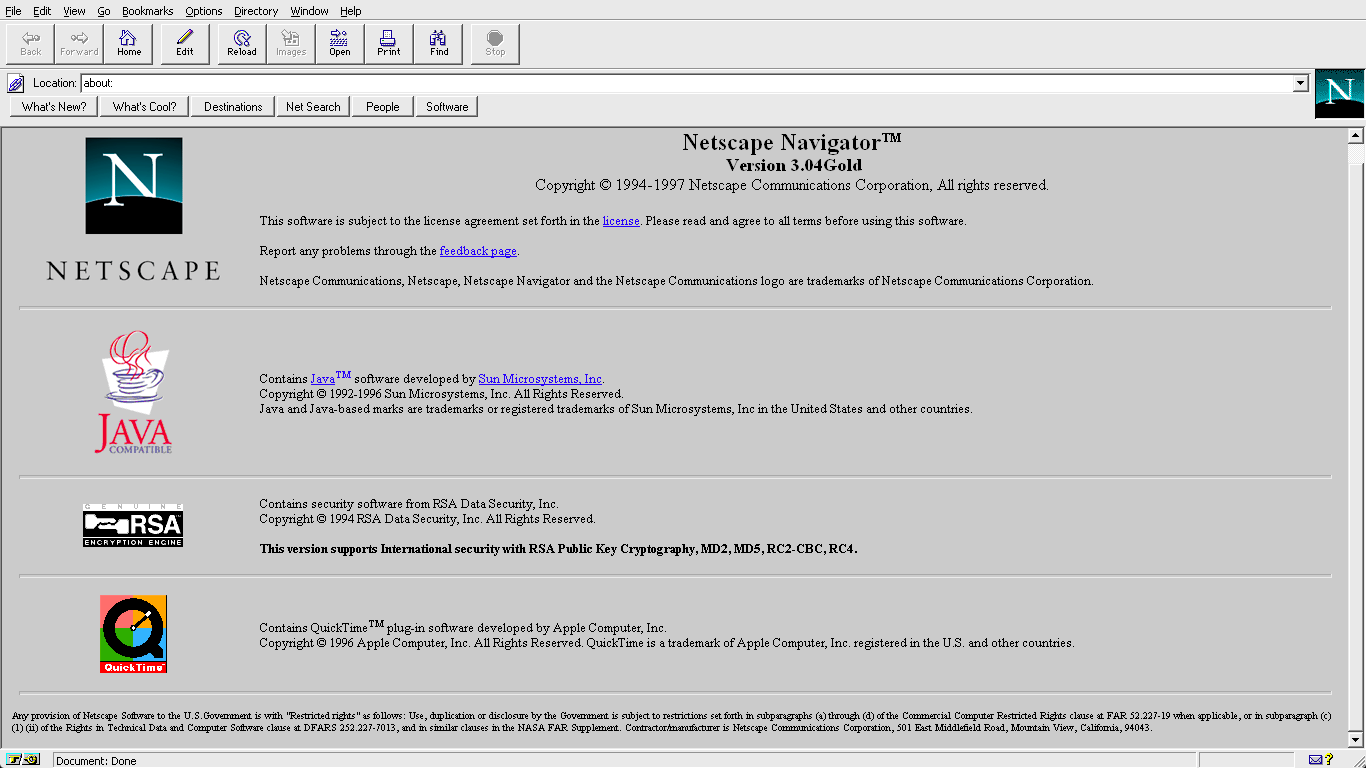

3. Netscape and Windows 95

Personal computers were getting exponentially more powerful and cheaper, and the percentage of households with computers was growing rapidly. When Microsoft’s new OS, Windows 95, was released, it made personal computers so much easier to use than ever before, and at an affordable price.

A new browser called Netscape Navigator made the World Wide Web much easier to use than ever before. The founders of Netscape (a loss-making company with tiny revenues at the time) decided to cash in on the browser’s success through an initial public offering (IPO) just sixteen months after it had been formed. Netscape started a trend in the online world: going public on the Nasdaq.

Companies define an IPO price as the price per share they expect people will be willing to pay. Going public means a company’s shares, which were previously owned by the founders and other private investors, can now be traded by the public.

The Nasdaq is primarily known as the place to trade in high-tech, high-growth, and, some might say, volatile stocks.

Netscape went public at $28 a share. Despite Netscape being nothing more than a computer program, investors saw that the internet was the future. And with the excess cash that they had, they were more willing to take some risks. So basically, you have all these investors just throwing money at Netscape, and its share value ends up going to record-high levels in just the first 24 hours.

By the end of the day, the price per share had almost tripled to $75 and ended up closing at $58, earning them a market value of $2.9 billion in just a single day. Their valuation went from $0 to $2.9 billion in a year or so.

Dot-com Bubble and other internet companies

Plenty of other internet companies saw Netscape Navigator, a browser of all things, just make $3 billion in a single day. So, they all decided to do the same thing and take all of their companies public. Since the internet was the next big thing, tons of investors started investing tons of money in all of these companies that were going public. The fuse had been lit. Netscape showed the world that a company didn’t have to be profitable to go public. The view was that if a company could grow that fast, it would eventually become extremely profitable. This insane soar for Netscape suddenly meant that anything and everything with a.com in its name was a golden ticket to millions.

In the late 1990s, computers were getting faster and cheaper. Interest rates were low, and capital gains tax rates had been cut, all just adding fuel to the speculative fire. In 1999, there were 457 IPOs, most of which were dot-com stocks. 117 of those at least doubled on their first day of trading. These companies needed to grow as fast as possible to have more and more users. So, many companies invested mostly in advertising. All that mattered was getting bigger.

Dot-com Bubble: Was this just speculation and hype?

Everyone at the time wanted to either start an internet business or day trade internet stocks for a living. A lot of this spending was fueled by an endless loop of hype. Some companies were simply adding dot-com to their names. Others were going public without even having a finished product. For others, there was no business model, no customers, and no clear strategy for generating money in the future. but investors have been convinced to look past outdated metrics like profitability and valuation. Investors and business owners focus on the short-term growth of a business rather than the long-term.

In the ’90s, a dot-com stock was different from a traditional stock. It was a speculative investment. The values of speculative investing rely on subjective opinions and hunches rather than objective factors that can be measured, such as the business’s productivity, the quality of its products, et cetera. The problem with speculative investments is that the higher the return, the riskier the investment is. In other words, you are either going to make a ton of money or lose a ton of money. That is why speculative investments should be done in moderation. With non-speculative investments, you are much less likely to lose a ton of money, but it takes longer to make a return. Get-rich-quick schemes never work.

The Y2K

As the ’90s were closing in on the Millennium, there was a small issue with computers. The issue was a bug surrounding the way calendars worked on computers. It was assumed that old computer software was not built to recognize the year 2000, which would cause internal system errors. It could potentially wipe out a lot of computing infrastructure. Y2K is the shorthand term for “the year 2000”.

People, of course, scrambled to get this bug fixed. The scare led to a wave of computer equipment upgrades, boosting the market and all of the hype around various companies and attracting even more investment money. More and more investors are getting into the mix, amateurs and professionals alike. People left their day jobs to trade stocks full-time. People completely ignored all rationale. They were instead purely motivated by overconfidence fueled by media sensationalism and a false perception of what the internet was becoming—this moneymaking machine. Y2K was portrayed as the end of the digital world as we knew it, and it just turned out to be nothing.

Dot-com Bubble: Looking past the hype

When you look past the hype, at the end of it all, a company must generate cash and produce a profit. It’s that simple. The internet, however, was completely brand new. The internet hadn’t been around long enough for investors to properly map it out.

They didn’t know the up-front costs and requirements of running these companies. Most of these companies had only been in existence for six months. Everyone was learning on the job. They didn’t know how to prepare for what might go wrong since they didn’t know what could go wrong because they hadn’t been around long enough for anything to go wrong. Also, there was not enough knowledge of when was a good time to invest, how much they should invest, or whether an internet investment would even go places.

There was only speculation, and speculation without information is called a guess. One of the biggest contributors to the dot-com bubble was that everyone was just guessing. They were just throwing money in random directions at every internet company and hoping for the best.

However, companies like Amazon and eBay were born in the 1990s and not only showed promise but also had successful business models.

Dot-com Bubble: The bubble bursts

From 1998 to the year 2000, the bubble grew a lot. This growth was based mainly on new investments and not on actual profits generated by the services that these internet companies offered. After a series of the following events, the bubble went pop.

In February 2000, Alan Greenspan a rise in interest rates. This announcement made speculation to grow rampant, as it was unclear how the higher borrowing costs and increased interest rates would affect Dot Com stocks.

On March 13th, 2000, Japan announced a recession. Japan was a crucial player in the tech market, so this news started a worldwide sell-off of already vulnerable stocks.

At the time, Microsoft faced a failed early settlement in a case involving internet browsers, resulting in 15% losses and an 8% drop in the NASDAQ.

It was only then that Investors and analysts raised red flags. They looked at the numbers and realized that these companies weren’t making any money. These companies couldn’t justify their insanely high valuations. They were being held up completely by investors. People began to panic sell, and the values of the values of these websites went down and disappeared, as did all the money invested in them. All the hype was gone, and all those promises of overnight millionaires disappeared. The bubble has now burst.

In 2000, dot-com companies had only one direction: down. They experienced a significant downturn, losing 22,000 jobs and 75% of their value. It was like over half of all the popular websites disappeared. Five years of hype, speculation, advertising, and dreams disappeared in just 14 months. trillions of dollars in wealth vanished even faster than it had appeared.

Dot-com Bubble: The Survivors

But some companies, like Microsoft, Google, Amazon, eBay, and Apple, survived. However, their stocks plummeted. Amazon, for example, went from $107 to just $7; Apple went from $5 to just under $1. These companies had used their investment money to grow the company and generate profits. They had a solid business model and brilliant people at the helm. They ended up becoming the absolute powerhouses that are still around today.

Most of today’s companies do have technology that works, rather than a rough business plan and some venture capital funding. The internet proved itself to be more useful with the rise of social media, streaming, and other things that are less speculative and more convenient than the real world.

The Dot-Com Bubble was a learning experience. We shouldn’t make life-altering decisions based on things we know nothing about. And we most certainly shouldn’t rush those decisions. We need to be patient and better understand what we are getting ourselves into. That is the only way we can ensure that we have a better future.

Conclusion

The Dot-Com Bubble of 1995-2000 was a period of extreme speculation and hype surrounding internet-based companies. It was fueled by low interest rates, the popularity of the internet, and the emergence of new technologies like the browsers like Mosaic and Netscape and Windows 95. In this period investors poured money into dot-com stocks, regardless of their lack of profitability. The Y2K scare further inflated the bubble, leading to a frenzy of investment and overconfidence.

However, the bubble eventually burst in 2000. It became evident that many of these companies were not generating any profits. The aftermath saw the collapse of numerous dot-com companies, resulting in massive job losses and the wealth disappeared. On the bright side, survivors like Microsoft, Google, Amazon, eBay, and Apple emerged stronger due to their solid business models and strategic investments.

The Dot-Com Bubble is a cautionary tale about the dangers of speculative investing and the importance of sound business fundamentals. It shows the need for patience, due diligence, and a clear understanding of the industries we invest in to ensure a more stable and prosperous future.