In this article, we will discuss two main topics. One is about why a central bank was created and the other is the idea of fractional reserve banking. But first, let us do a recap of the previous article where we learned about paper money and the emergence of banknotes. In a nutshell, in the year 1640 in England, the relatively disliked King Charles was experiencing financial difficulty. He was deeply in debt. So to get money, he not only seized the money in mint but was also claimed as one of his notorious forced loans. The money in the mint was not his. It belonged to the merchants and goldsmiths of London.

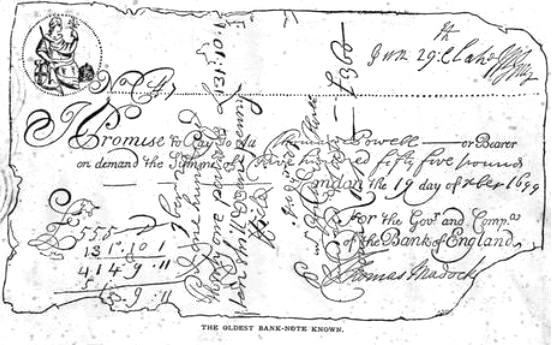

This decision eventually led to his death. Later, the merchants and goldsmiths got together and turned the vaults into banks. The goldsmiths served as the trustees. When people deposited gold, the goldsmiths would give them receipts. The receipts were later used as currency. This practice evolved to the point where people requested multiple receipts in smaller denominations, leading to the creation of banknotes, the foundational form of paper currency.

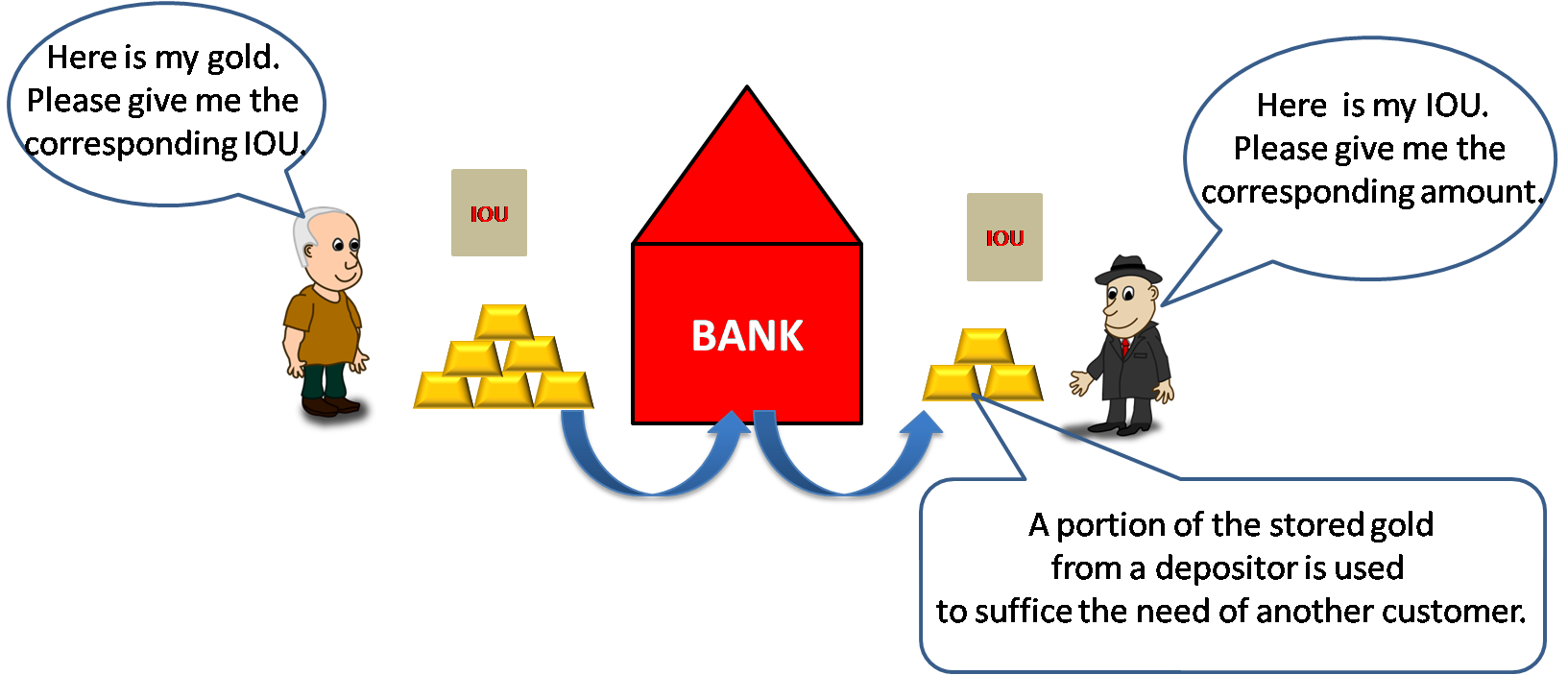

The goldsmiths were intelligent people. They started loaning people money. Eventually, they began to notice an interesting trend with banknotes. They were being passed from one person to another but were not being returned to the bank very often. As long as everyone doesn’t try to exchange their banknotes all at once, the bank can lend more money than it holds in its vaults. As long as the banknote circulates or goes from hand to hand, the bank can use the coins that the note represents to lend to someone else or serve the person who wants to exchange their banknote. This in turn led to the creation of fractional reserve banking, which made money magically multiplied forthwith in England.

Any time a new revolutionary concept is brought into the public domain, there is a learning process involved to understand the positive and negative consequences, as well as the unaddressed problems that accompany it, before we can properly use that concept. This was the case with paper currency as well. Each bank was issuing its notes, which led to confusion and chaos. A lot of questions arose. Who will be responsible for printing the money? How much money should be printed? The absence of a centralized currency system posed challenges. There was a need for regulation and the issuance of money. It became clear that a single and reliable currency was required for each country. A remarkable invention called the Central Bank resolved almost all the challenges associated with transitioning to paper money.

The First Central Bank

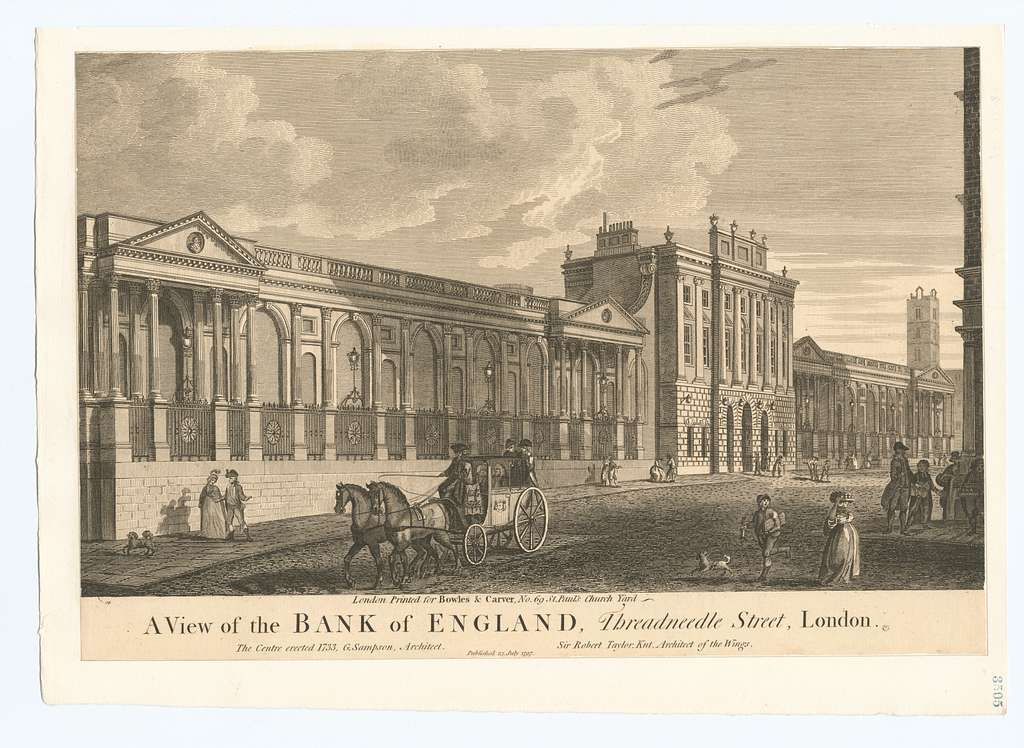

During the 17th and 18th centuries, wars were extremely expensive. Troops and supplies had been sent worldwide, and navies needed to be maintained across various oceans. This led many European countries to face financial collapse due to excess debt caused by the wars. To face this issue, some thought that creating a bank to manage the national debt would be the solution. After much discussion, the Bank of England was created in 1694. This institution was created to fulfill the function of the government’s debt management. This was particularly significant because if the government had all its banking done with this bank, then the bank would be more secure.

This therefore meant that the bank would have to have branches or at least maintain good relations with the other banks all over the country. Eventually, people put more value on Bank of England banknotes than others because of the degree of security offered. Surprisingly, there were times when people were ready to pay a higher price than the face value of one pound for these notes just because they were trusted and universally accepted.

The Bank of England note officially became the country’s sole paper currency in 1844. This solidified its position as the leading banknote issuer in England. The Bank Charter Act of 1844 ensured that no new bank would be authorized to print banknotes. Furthermore, when a bank was purchased, it was required to remove its notes from circulation. Consequently, over time, the Bank of England banknote became the sole paper currency in the country. Nevertheless, it was not until 1921, about a century ago, that the last non-Bank of England bank in the country stopped issuing its banknotes. However, few banks in Scotland and Ireland still enjoy the privilege of printing pound sterling notes even today.

Fractional Reserve Banking

It is also referred to as the infinite money glitch. This is the process of creating currency by private banks. It happens when a bank lends out more money than it has available, under the assumption that not all individuals will withdraw their money at the same time.

Here’s how it works: If somebody deposits $1,000 into the bank, the bank does not keep all of it to itself. Instead, the bank holds on to 10%, which is $100, as reserves. With the remaining $900, the bank lends it out to other people or businesses, and they pay interest on the loan, thus making more money for the bank. The person who borrowed the $900 uses that money to pay someone else, who then deposits it back in the bank. The bank keeps 10% of that deposit, which is $90, and lends out the remaining $810.

This process goes on for every new loan, and this becomes an endless cycle. Finally, the bank can lend out $10,000 for an initial $1,000 deposit. This happens instantly due to the high number of transactions in modern banks. This process of money duplication is also known as the monetary multiplier effect or the infinite money glitch.

What is interesting in this instance, is that if you start with $1,000 in the economy, you can turn it into $10,000 without having any more money. $9,000 is essentially created out of nowhere. If you multiply these numbers by adding more zeros, you will start to comprehend how much money is created through fractional reserve banking in an economy.

This “infinite money glitch” occurs as banks have to keep a minimum part of deposits to fulfill liquidity requirements. They use the rest of this money to make more money from lending. Bankers can create money out of thin air, while the rest of us have to earn it through work. Nevertheless, this type of monetary system creates a situation where the money supply will surpass the actual amount of gold or silver that is prevailing in the economy. This system is being used all over the world, which is one reason for the current state of our economies.

Drawbacks of Fractional Reserve Banking

This type of banking enables a bank to lend out more money than it has. So what happens if everyone decides to withdraw their money from the bank simultaneously? If people start to believe that the bank cannot repay them, whether this is due to issuing too many banknotes or making bad loans, they rush to the bank to retrieve their money. This phenomenon is referred to as a bank run. Hence, the bank is not able to fulfill the wishes of all its customers because it keeps only a small amount of the required funds at any given moment. Consequently, the bank fails, and everyone loses. If you had any money left in the bank, it was simply wiped out.

If this starts happening on a large scale, it creates another problem: customers lose confidence in banks and stop putting their money in them. Instead, they keep it for themselves. They start hoarding it because they are afraid the banks will fail. While this is happening, banks try hard to prevent deflation of the currency by amassing as much actual money (for instance, gold and silver) as possible so that they can pay all those who are withdrawing their money from banks, thus avoiding bankruptcy. Hence, a large sum of money is removed from the economy. It stops circulating, and we are back to our initial issue of not having enough money to keep the economy functioning properly.

The Role of a Central Bank

It acts as a backup lender for banks in urgent need and a lender of last resort. A bank could collapse even if it is financially stable but does not have enough capital to handle a panic or a sudden run on it. This could lead to a scarcity of money in the country. This is solved by the central bank lending real money to these banks and addressing their liquidity issues.

Additionally, the central bank frequently subjects banks to stress tests. They simulate situations like a potential bank run or a financial collapse. These tests check if banks have enough liquidity to withstand such situations. These simulations are done to prevent a banking crisis. Nevertheless, the banking system can collapse when abnormal and unusual default rates occur, which are mostly caused by fraud. This level of caution is usually enough to keep the whole modern banking system from descending due to the infinite money glitch.

Moral Hazard

The central bank is there to provide necessary help to banks. It offers assistance to banks that may be confronted with short-term financial problems. The central bank lends these banks’ mone, so they have enough cash to handle the immediate problems. However, this assistance creates a risky situation called a moral hazard. When the central bank bails out banks, they are encouraged to be more risky because they know they will reap the rewards if things go well but will not carry the burden if things go wrong. It’s like giving a gambler someone else’s money and telling them they can keep all the winnings but don’t have to repay any losses. This is what led to the banking crisis in 2008.

Conclusion

Having a bank that is essentially fail-proof unless the government fails is incredibly powerful. Its main function is to guarantee the robustness and stability of the economy. The Central Bank’s performance is directly dependent on the government’s well-being. This has brought about a global economy that is no longer restricted by the amount of gold and silver exchanged. At present, the currency has ceased to be tied to any tangible value, and its worth depends solely on our faith in its efficiency. Money works because we believe it works. Our next article will explain the mechanism through which central banks create money.