The current monetary system brings into being an unlimited currency supply, which in extreme cases creates inflation. The invention of money helped humans advance from the Stone Age. Nevertheless, the vast increase in economic activity during the Industrial Revolution in the nineteenth century required a relatively inelastic means of payment. This also resulted in the introduction of currency alongside the establishment of central banks.

One of the tasks of a central bank is to control the money supply and make sure prices remain relatively stable. It simply prints money, thus increasing the money supply, and raises the interest rate charged on loans to decrease it. The creation of currency is largely based on debt, a system called the debt-based monetary system.

At the moment, central banks and commercial banks can create currency via digital means while increasing the supply of funds by merely entering trillions of digits into their computer systems. The majority of money, about 97% to 98%, is created digitally in this way, while only 2% to 3% exists as physical cash and coins. Only central banks have the authority to print money. But, commercial banks can lend out up to 10 times more money than they hold in reserves through fractional reserve lending.

Definition of Inflation

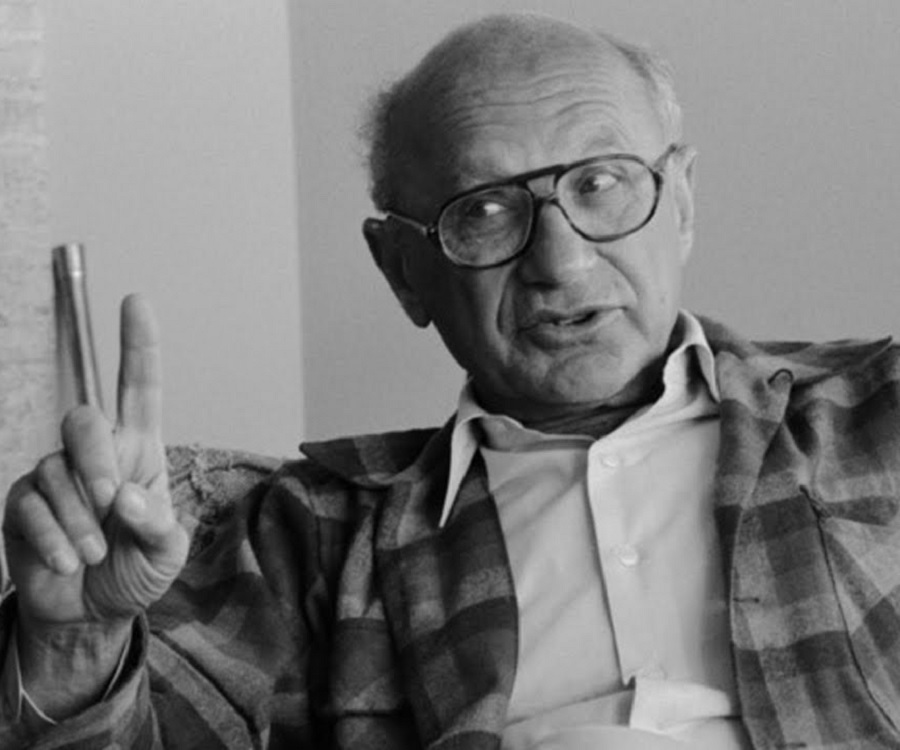

When discussing inflation, I rely on Milton Friedman‘s definition. He describes inflation as an expansion of the currency supply, while deflation is a contraction of the currency supply. The more currency we have, the more prices rise. The prices of everyday goods and services act as a sponge on an expanding currency supply. Rising prices are merely a symptom of inflation.

Governments and banks systematically continue to increase the supply of money by printing more and more of it and by lending more and more money out simultaneously. The entire currency supply is nothing but a supply of numbers. Some of them are printed, and most of them are typed into a computer. We earn some of this money through our work.

A high rate of inflation acts like a thief, increasing the cost of every expense. As more currency is created, prices rise accordingly.. It is also like a hidden tax that we all have to contribute to to increase the currency supply. The easy money we have now comes at the cost of having higher taxes for future generations. For instance, housing is a major expense for most people. The increasing house prices may give you the impression that your wealth is growing. However, as your wealth grows, your children’s wealth diminishes. This means that there is no actual overall wealth gain. Your children will have to pay more to buy a house in the future. Consequently, they will need to earn more and possibly incur more debt.

Inflation in Practice

Inflation – increase in currency supply

Let’s explain what inflation is using a simple example. Imagine a village of people who only have one market where they buy all their needs, such as food, clothes, and other necessities. The government comes in one day, and they express worries about the village’s economy. They inform the villagers that if they want to take out a loan, they will ensure that the banks will offer low-interest rates. The government wants to encourage them to borrow and spend money. Besides that, the government also gives all villagers a large amount of money. Consequently, the villagers feel wealthy with the new cash and start buying more things at the market.

Many of them have been eyeing fancy products on the market. Some even purchase items they couldn’t afford before, like a fancy television. The market owner struggles to keep up with the high demand. On the other hand, he is pleased with the increase in sales. Due to this, the market owner decides to raise prices, leading to inflation.

Deflation – decrease in currency supply

What will happen if this situation continues at this pace? The market owner has already increased the price of TVs. Taking into account the low-interest rate, he decides to take a loan and build a TV factory. This is good; his business is growing and expanding. At some point, government funding eventually runs out, and prices remain high. Consequently, the market owner has no one to come buy his expensive TVs. Now he has this factory and more employees, but no customers. Hence, the market owner has no choice but to shut down the factory, dismiss workers, and eventually reduce the prices of the TVs. This situation is known as deflation.

The village represents the collective community, while the market symbolizes the overall economy. When there is a lot of money in circulation, people always have a reason to spend it.

How Do You Prevent or Control Inflation?

Regulating the supply of money to match or be less than the actual economic activity can prevent inflation. The best way to achieve this, in my opinion, is to only issue money for investments in productive goods and services. For example, the giving of funds to a small business to create jobs and improve people’s purchasing power will aid in preventing inflation.

Another approach is for the central bank to increase the interest rate, making loans more expensive for individuals and businesses. This leads to a decrease in the number of loans being requested and approved. Also, the government might choose to cut its spending. This results in lower demand for products because the country is spending less money. Consequently, there is less money circulating in the economy. Both methods reduce the amount of currency in circulation.

Causes of Inflation

There are many causes of inflation. Below are the main ones.

1. Demand-Pull inflation.

It is the situation when the demand for a product is higher than the existing supply can meet. In other words, customers want more than producers can offer. This is often seen when people have more money to spend. As people become wealthier, they tend to buy more goods and services.

2. Cost-push inflation

This occurs when businesses experience rising costs that are subsequently transferred to customers. Various factors can contribute to these cost increases. First off, the price of the major raw materials, such as oil, might rise. Further, if there is a scarcity of factories and offices being constructed, rents could rise. Besides, the employees may insist on getting higher wages and be successful in getting them, either through their strong political organization or as a result of a lack of skilled workers from colleges and schools.

To cover their extra expenses, firms have to ultimately pass their costs on to consumers by increasing prices. Although they may not want to do this, it is a necessary step for survival, as they risk going out of business otherwise.

3. Increase in Currency Supply

Banks and governments usually pump money and credit into the economy. Governments can boost the currency supply by printing more currency, thereby increasing the circulation of notes and coins. Apart from that, they can cut down on taxes, the interest rate on loans, or even mortgages; hence, in the long run, people can have more income at their disposal. This, in turn, allows people to have more money to spend. However, a major issue arises when this happens over time. This leads to a decrease in the value of currency as more money is in circulation chasing the same amount of goods. This results in increased prices but not necessarily an increase in purchasing power.

Impact of Inflation

1. It encourages investment

Investors typically view inflation as positive because it encourages investment. The government, through intentional inflation, can stimulate economic growth in the short term. This allows businesses to hire more employees and invest in new equipment, thereby boosting production. Moreover, this process results in more goods being available for sale in the market. Nonetheless, this strategy is risky and can often have negative consequences.

2. Increased minimum wages

Fiat currencies tend to depreciate within a certain period through inflation or a decrease in their purchasing power. Knowing this fact, you will invest it in assets that increase in value over time to offset the decrease in value. Therefore, inflation typically harms individuals who have little to no assets and limited cash for investing. When these individuals do not receive raises in their wages, their salary effectively decreases in value over time. Countries increase their minimum wages for this reason. Also, companies and other employers often give out yearly raises.

3. Effect on savings

Moreover, inflation hurts savings because it devalues the purchasing power of money you may have saved in the long run. When banks and the government issue more currency, the value of existing currency decreases as a result. Even though the balance in your bank account remains the same, the purchasing power of that money diminishes due to the increase in the circulation of new money. By keeping your wealth in fiat currencies like the US dollar, you are essentially losing value over time. It may seem to you that the amount of your bank balance remains unchanged, but the truth is that the value of those funds eventually decreases over time, thus reducing your purchasing power.

4. Transfer of wealth

The creation of fiat currency by banks and the government enables private banks to extract wealth from the economy. They can repossess your assets, like your house when you default. This, in turn, results in a sad decrease in the quality of life people enjoy. As individuals become poorer, they increasingly rely on taking on more debt.

5. Hyperinflation

In an extreme case of inflation, your two hundred shilling note could be worth 50% less. This means that your hundred-dollar bill is now worth what? In some cases, inflation may become uncontrollable because of a decline in consumer confidence and other external factors. This may cause hyperinflation, which is a sudden and rapid loss in a currency’s value, leading to an economic slump. However, inflation is typically a well-regulated factor in modern economies.

Conclusion

Prices increase because we struggle to control the complex economic system. Ideally, we would maintain stable inflation by balancing the amount of money in circulation with the quantity of goods available. However, achieving low inflation is challenging because of several factors, including material costs, labor costs, productivity, taxes, exchange rates, the economies around us, interest rates, and government policies. In the end, we may need to accept that inflation is like weather or emotions—inherently unstable. It is something we must learn to live with as we strive to manage its fluctuations. Embracing and managing inflation requires wisdom.