Financial literacy is the ability to know how to use different financial skills and terms fluently to make smart money decisions. These skills include budgeting, managing debt, investing, and planning for retirement. If you lack these skills, you may be financially illiterate.

An education in finance places you in a position to make informed decisions about your money. It will help you build a lifetime of financial knowledge. A good understanding of money, including how to use it wisely, can help you accomplish your goals. These goals may, to an extent, include saving up for school or retirement, using loans correctly, and simply establishing a business or company. It will be very hard to be deceived by scams if you are knowledgeable on personal finance issues. Begin learning money matters early on in your life so that you set yourself on a path of financial success.

Money is an accepted payment for goods and services. When you work, you’re either providing a good or service. For most people working takes up all your time. So, essentially, you’re trading your time for money. You can make all the money in the world but you can only have so much time. So why are people so inefficient with their money? Because they’re financially illiterate

Problems of financial of illiteracy

People who do not understand finances can face various problems. For example, they may accumulate insurmountable debts. This could be as a consequence of poor spending decisions or not setting a clear plan for the future. This could in turn result in having a bad credit score, filing for bankruptcy, losing your home, and facing other negative consequences.

Money is power, and being equipped with good financial literacy skills means making the most of your resources and making the right financial decisions that will lead to a successful life. Financial literate individuals are more likely to have savings, an emergency budget, and start a retirement account than people who are not so knowledgeable.

The 5 Principles of Financial Literacy

Financial literacy is based on five key principles:

- Earning income or Making money

- Spending and financial planning

- Saving and investing

- Borrowing and managing debt

- Protecting your wealth

These principles function as a compass that can assist you in managing your finances. They are the building blocks of a strong financial base. You need to understand them and putting them into practice, both now and in the future. They might be the key to improving your current financial situation.

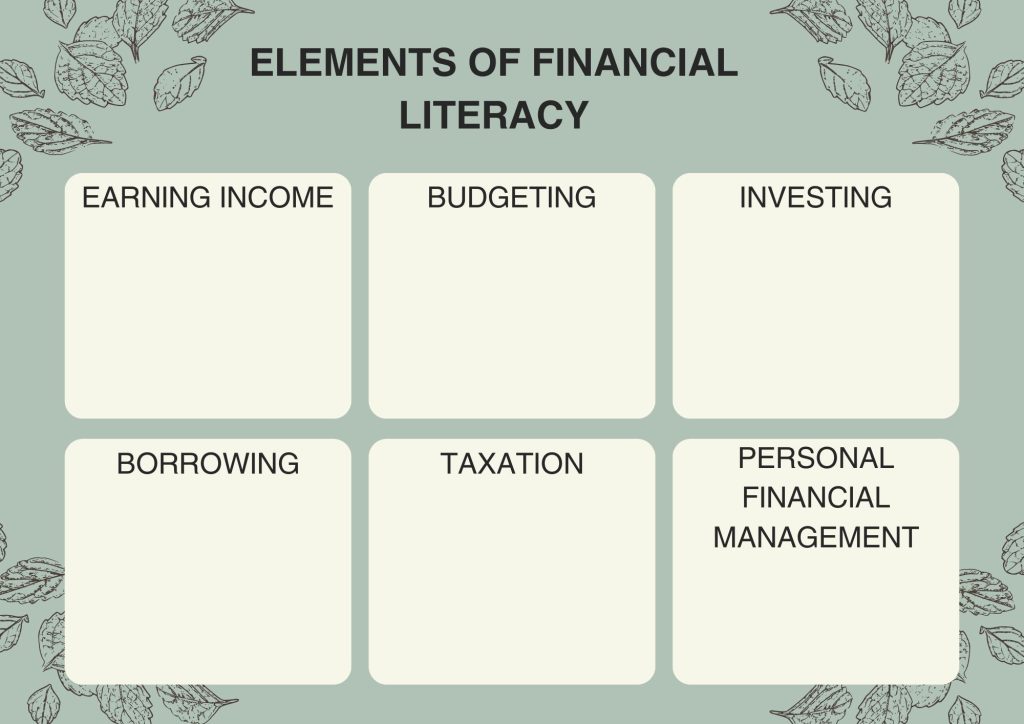

Key Elements of Financial Literacy

They are the skills, knowledge, and abilities that help people to master all matters about money and debts. Here are the basic constituents of financial literacy which must be known by every person.

1. Earning income

Earning income is the base for managing your finances. The stronger your financial base, the easier it will be to manage the rest of your financial matters. There are different methods of earning cash. For example:

- earning a salary or wages from a job,

- income from running a business,

- interest earned from a high-yield savings account or bonds,

- receiving dividends as a shareholder of a company,

- earning rental income,

- making profits from investments in the stock market or real estate,

- receiving royalty payments for allowing others to use your property. Royalty income can come from music, books, photos, and patents.

2. Budgeting (Managing your money)

Budgeting is the process of allocating your limited funds to expenditure, investment, savings, and donations. It helps you to balance the spending of your income between clearing off debts, being able to save, and making investments.

3. Investing

You have to learn essential topics like interest rates, prices, diversification, risk management, and indices when you are investing. This will help you make better financial choices which would result in improved income.

4. Borrowing

Before applying for a loan, you need to know about certain topics. They include interest rates, compounding interest, time value of money, repayment due dates, and loan terms to borrow intelligently among others. This knowledge will help you to make smart borrowing choices and prevent financial issues in the future.

5. Taxation

Understand the various ways taxes are imposed and how they impact your income after tax reductions. Every form of income, including salary, investment, rental property, inheritance, and others, is taxed at different rates.

6. Personal financial management

It involves combining various elements mentioned above. To efficiently control your finances you should develop a mix of high savings and investments and low borrowing and debt. Other elements include protecting money through insurance and the various risk management methods.

Why financial literacy matters

You will

- learn how to budget, keep track of expenses, repay debts, and plan for retirement. These concepts will help you manage your money better and make better financial decisions. This knowledge will help you be more independent and aid you in attaining financial stability.

- gain an understanding of how money works, setting and achieving financial goals, recognizing wrong financial practices, saving for emergencies, and dealing with financial difficulties. Therefore, you will be better prepared financially for anything that may take you by surprise like a job loss or a major unexpected expense.

- reach your financial goals by creating a well-thought-out plan defined by clear objectives. This plan will also protect you from surprises or unexpected financial problems. Budgeting, saving money, and being accountable to your financial desires, will make the future that you want come true for you.

Benefits of Financial Literacy

You’ll

- have a successful and financially secure life by learning how to manage money in a good way.

- be a smart financial decision-maker by gaining skills to make smart financial choices. The skills are problem-solving, critical thinking as well as the basic knowledge of personal finance.

- be better at decision-making especially when it comes to picking insurance, loans, investments, and using credit cards ethically.

- create a budget that is well-organized and effective.

- have the ability to be in control of your money and debts as well as hit your financial targets.

- save more money by managing your expenses better and get rid of unnecessary expenses thereby cutting the financial tensions and troubles.

How can I become financially savvy?

To achieve financial literacy, you need to sharpen skills such as budgeting, debt control, credit recognition, and investing. To better your financial standing, you need to start by creating a budget, tracking your expenses, paying bills on time, saving money, keeping an eye on your credit report, and investing for the future.

How can I educate myself about financial literacy?

To get started, you’ll find some free information on various platforms like YouTube, blogs, podcasts, budget planners, financial calculators, price comparison tools, and many more. It’s important to start learning early. You can also go further by purchasing books, courses, and programs, or seeking guidance from mentors and experts.

The best way to learn financial literacy is by doing it and putting it into practice. For example, you could educate yourself on budgeting and then actually prepare one. Start with a small budget and continue to do so consistently over the years. Through these events, you will commit errors, gain knowledge of them, and master the art.

Conclusion

Financial literacy is about knowing how to handle your money properly. It is also about making the right financial decisions. It is essential for building a successful financial future. You can make educated choices that will boost your financial well-being and security with an in-depth knowledge of topics like budgeting, investing, borrowing, taxes, and personal finance. Financially literate people have a better chance to reach their goals, avoid unwanted debts, and make sound financial decisions.

With financial basics, you can avoid losing sleep over money, build stronger economic health, and work towards a better financial status. Remember, the key to becoming financially literate is to start learning and taking action as soon as you can. Cash matters to everyone. And the more cash you have, the more freedom you gain. Make an effort and educate yourself on everything related to financial literacy to reach your targets and live the life you want.