Deflation is the contraction of the currency supply. Most countries have a central bank that acts as a key player in the country’s economy. It can engineer the growth and decline of the economy time and again. Think of it as the mastermind behind the scenes, manipulating and disrupting economic activities while we play our parts as puppets. In essence, central banks can indirectly sway consumer spending habits. Through various tactics, the central bank influences how businesses adjust their prices. It can use tools such as interest rates and the group psychology of human nature to intentionally create economic booms and busts.

Definition of Deflation

Milton Friedman describes deflation as the contraction of the currency supply. The less currency we have, the more prices fall. The prices of everyday goods and services act as a sponge on an expanding currency supply. Falling prices are merely a symptom of deflation.

One powerful tool at the central bank’s disposal is the interest rate. By adjusting this rate, the central bank can control the cost of borrowing money from banks. They can increase the interest rate and make it more expensive to borrow money from banks. When the central bank raises the interest rate, this increase in borrowing costs is passed on to businesses and consumers through higher loan and mortgage rates. It effectively discourages borrowing and spending. As interest rates climb, people and businesses are more likely to save rather than borrow. This reduction in currency supply is known as deflation.

Causes of Deflation

Deflation occurs when the economy is struggling. There are various reasons for deflation. We have listed the most significant ones for you.

1. Raising interest rates

The central bank controls the main interest rate by adjusting it up or down. When the main interest rate goes up, loans become more expensive for individuals and businesses. This leads to a decrease in the number of loans being requested and approved.

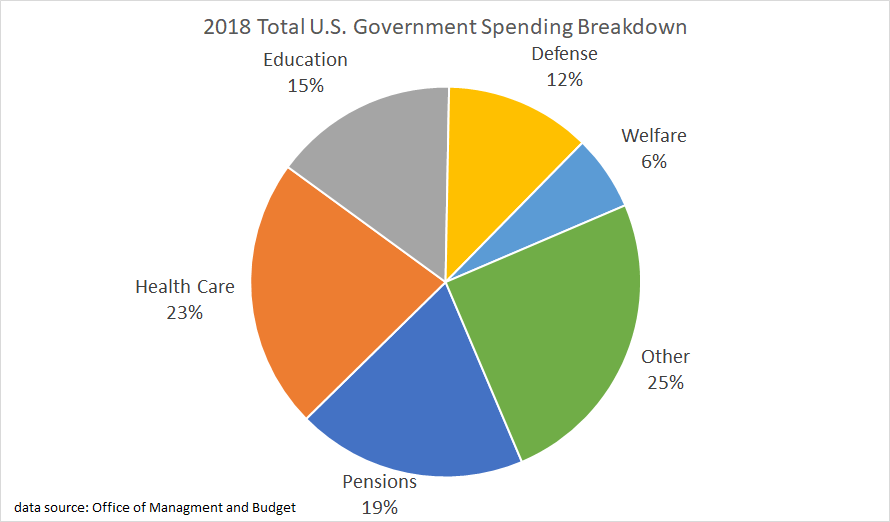

2. Decreasing government spending

A nation might choose to cut government spending to lower its national debt. This results in lower demand for products because the country is spending less money. Consequently, there is less money circulating in the economy.

3. Consequences of an Economic Downturn

When people feel uncertain about the economy’s behavior, they tend to start saving money. This leads to a decrease in the demand for goods and services. This decrease causes prices to drop. As prices continue to fall, companies cut production costs, lower wages, and may have to lay off workers. In severe cases, businesses may be forced to halt production and shut down completely.

The Deflation Spiral

Deflation can be a problem because it sets off a chain reaction. In the past, businesses and individuals could borrow money from banks. However, high-interest rates make it difficult for some people and companies to take out loans. This results in less money circulating in the economy.

When people and businesses have less money, they tend to spend less and save more money. As a result, there is lower demand for goods and services, causing prices to drop. This decrease in prices reduces profits for businesses. To make up for lost sales and reduced profits, many people have to accept lower wages. Some may lose their jobs. Some enterprises may even go out of business. This leads to a further decrease in prices and creates a cycle known as the deflation spiral. In the deflation spiral, falling prices lead to lower production, which leads to reduced wages and demand, resulting in even lower prices, further perpetuating the cycle.

Some people have managed to keep their jobs, and their income has been steady during this time. Others have enough money to continue buying everything they need. But they are hesitant to spend because they are hoping for prices to drop even more. Also, when they see their neighbor struggling financially, it can make them more cautious about spending, consume less, and be inclined to save money.

How Do You Get Out of Deflation?

Governments and central banks have several tools to combat deflation. One option is for the central bank to decrease the interest rate, making loans more affordable. Another approach is to boost government spending, prompting the state to act as a consumer. Both methods inject more money into circulation, stimulating spending by individuals and businesses.

Cycles of Inflation and Deflation

We have been borrowing increasing amounts of money to sustain our lifestyle. This continuous borrowing increases the currency eventually causing inflation. Now, we have reached the point where we can’t borrow any more. Banks are becoming more cautious about giving out loans. Also, many people are focused on paying off their current debt rather than taking on more. While it is a wise and responsible decision, it poses a significant danger to the worldwide economy.

The global economy operates like a massive Ponzi scheme. It heavily depends on the constant borrowing of larger and larger amounts of debt to sustain itself. If individuals try to limit their spending to their current income, it can lead to a decrease in the money supply. Also, how will interest payments on existing debt be made? This results in a need to borrow more money each month to cover the interest on existing debt.

Hence, the central bank, which controls the economy, will once again manipulate economic factors to boost the money supply and encourage spending. This will lead to periods of inflation and deflation. In the current system, there is a need to keep expanding the money supply to prevent the economy from collapsing.

Conclusion

Deflation is a significant economic occurrence with broad implications. Central banks are important in controlling deflation by adjusting interest rates and cutting government expenses. When deflation takes hold, it can result in lower production, decreased salaries, and higher unemployment, leading to a difficult cycle to break. Understanding how inflation and deflation affect the economy can guide us in making well-informed financial choices as individuals. The connection between inflation and deflation highlights the careful balance that central banks need to uphold for global economic stability.