Ray Dalio’s free YouTube video “How the Economic Machine Works” is one of the most practical, straightforward, and useful guides to understanding macroeconomics. Dalio used this template to understand the macroeconomic environment for decades, and it contains key ideas such as debt, cycles, deleveraging, and depression. This is one in a series of posts that will break down and simplify his views. This article discusses productivity growth and debt cycles.

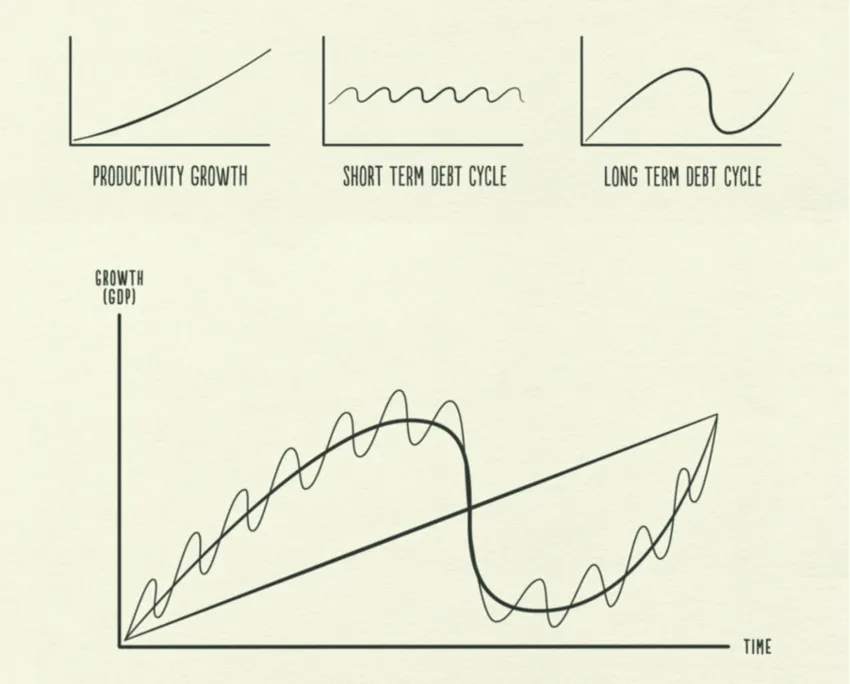

Productivity growth and debt cycles, both short-term and long-term, are the primary drivers of the economy. These forces are generated through transactions, which are primarily influenced by human behavior. By examining these three forces and their interplay, we can create a framework for monitoring economic trends and understanding the current economic landscape.

Productivity growth

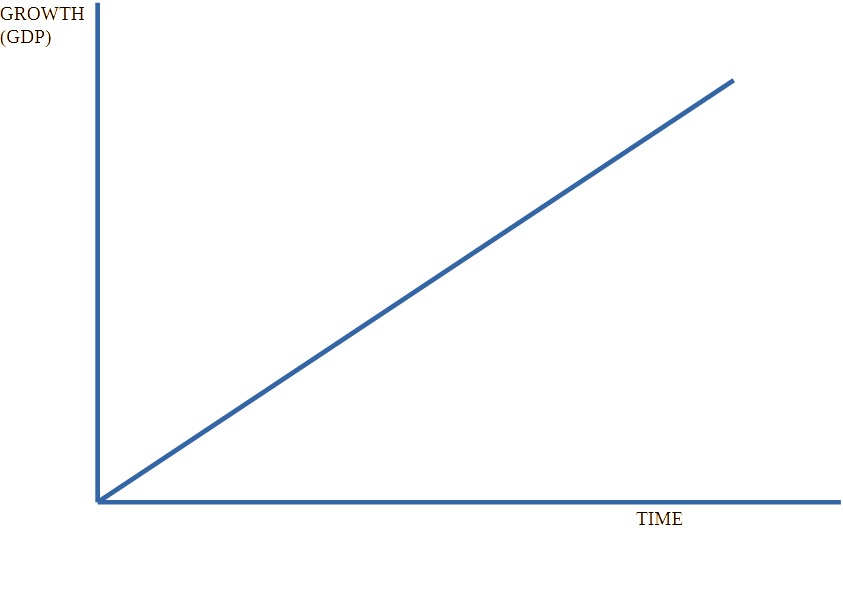

Over time, we learn and use this accumulated knowledge to improve our living standards. We call this productivity growth. If you are innovative and hardworking experience, you have higher productivity levels and consequently, you’ll see an improvement in your living standards at a faster rate compared to those who are lazy or content.

The only way to boost spending in an economy that lacks credit is by increasing your income. So, you will be required to be more productive and do more work. Increased productivity is the only way for economic growth. Since your spending is my income, the economy grows every time you, myself or anyone else is more productive.

If we examine transactions closely, we can observe a pattern that mirrors the productivity growth line. Productivity matters most in the long run as it remains relatively stable and doesn’t significantly contribute to economic fluctuations.

Credit

Credit is beneficial when it is used to effectively allocate resources and generate income to repay the debt. However, it can be bad when it is used to finance excessive consumption that cannot be repaid. For instance, if you take out a loan to buy a water pump. If this pump helps you increase the crop yield, income from the sale of these crops can help repay the debt and enhance your living standards. On the other hand, if I borrow money to buy an expensive shoe, this shoe does not generate income to repay the debt.

An economy that relies on credit has increased spending. This leads to a faster rise in incomes compared to productivity. However, this trend applies in the short term and not in the long term. Therefore, credit is more influential in the short term. It is a big driver of economic fluctuations.

Debt allows us to consume more than we produce when acquiring it. But, when we are repaying it, debt compels us to consume less than we produce. If you want to buy something you can’t afford, you need to spend more than you make. Essentially, borrowing allows you to spend money now that should be spent in the future if you can afford it. It is like you are borrowing from your future self. When you do this, you create a future where you will spend less than you make to repay the debt. Borrowing creates a repetitive cycle, known as debt swings. These cycles are a result of human behavior and the way that credit works.

Debt cycles

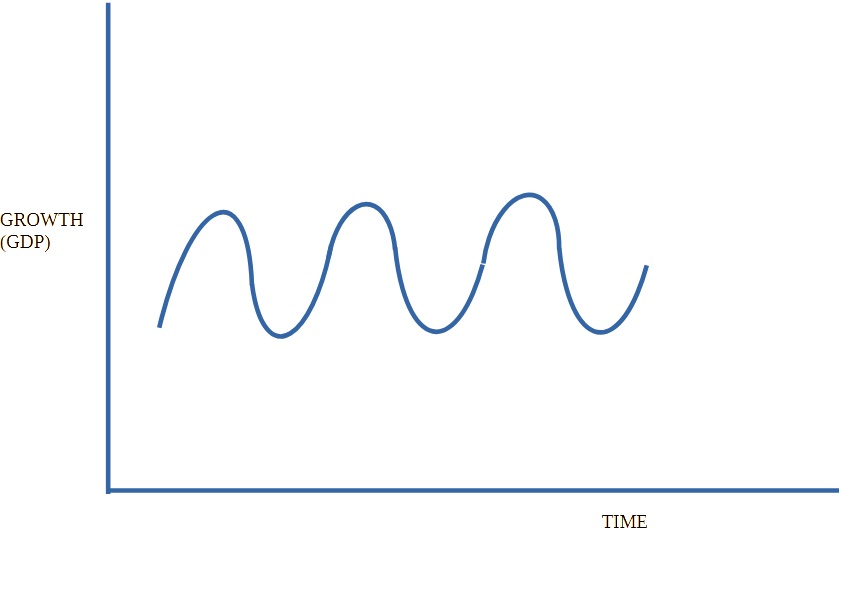

They occur in two major cycles, one lasting 5 to 8 years (the short-term debt cycle) and the other lasting 75 to 100 years (the long-term debt cycle). These cycles fluctuate around the productivity line due to the amount of credit available. This is why you need to understand the concept of credit as it initiates a systematic and predictable sequence of future events.

In the United States, the total credit amount is approximately $98.37 trillion, while the total money amount or the currency in circulation is only around $2.33 trillion.

The short-term debt cycles

It begins with an increase in economic activity called an expansion. This initial phase is characterized by increased spending, often fueled by credit. If spending and incomes grow faster than the production of goods, prices will start to rise. This price rise is an indicator of inflation.

The Central Bank raises interest rates to prevent excessive inflation. When interest rates are high, it becomes harder for people to borrow money. This results in increased costs for existing debts, which then leads to higher monthly loan payments. Consequently, people will borrow less and face higher debt repayments. As a result, the money left to spend will have been reduced. The overall spending will then decrease. Since my spending is your income, most incomes will then be reduced. This leads to a cycle where incomes drop and overall economic activity slows down. As spending decreases, prices will also decline, causing deflation. When economic activity decreases, we have a recession.

If the recession worsens and inflation is no longer a concern, the central bank will decrease interest rates to stimulate recovery. Lower interest rates means there will be a decrease in debt repayments and an increase in borrowing and spending, leading to another period of economic growth (expansion).

As you can see, the economy operates like a machine. During the short-term debt cycle, spending is limited by the willingness of lenders and borrowers to offer and receive credit. An economic expansion occurs when credit is readily accessible, while a recession occurs when credit is hard to come by. The central bank is mainly responsible for managing the short-term debt cycle. This cycle typically lasts about 5 to 8 years and repeats itself for several decades.

The Long-Term Debt Cycles

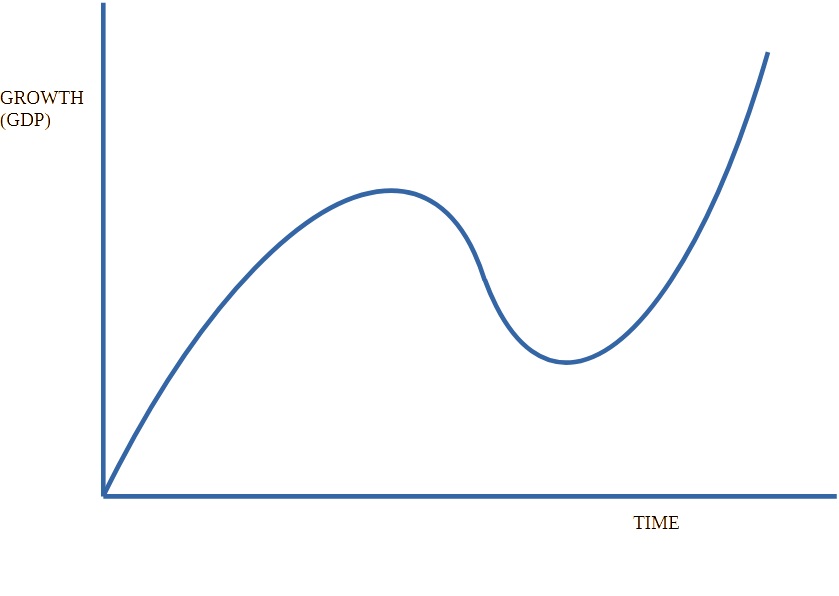

The long-term debt cycle is a timeline in which an economy goes through repeated episodes of growth and recession, with each phase resulting in a progressive increase in family debt until, eventually, a catastrophic slump resets the entire financial system.

When you closely monitor the short-term debt cycle, it consistently ends with increased growth and more debt at each cycle’s end. This pattern occurs because people tend to borrow and spend more rather than focus on repaying their debts. This behavior is driven by human nature, resulting in a scenario where debts increase at a faster rate than incomes over extended periods, leading to the Long Term Debt Cycle.

Boom, Bubble and Debt burden

Lenders continue to lend money more freely despite the increasing amount of debt people are taking on. This happens because everybody believes that everything is going well. People usually focus on recent positive developments like rising incomes, increasing asset values, and a strong-performing stock market. It seems like a period of economic boom. As a result, people use borrowed money to buy these goods, services, and financial assets. When this behavior becomes excessive, it is referred to as a bubble.

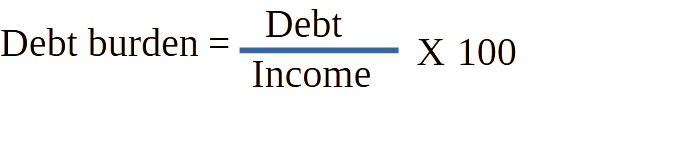

Despite the increase in debts, incomes have also been rising at a similar pace to counterbalance them. The debt burden can be defined as the ratio of debt to income. As long as incomes keep increasing, the debt burden remains at a manageable level. Simultaneously, the value of assets is on the rise. So, people take out large loans to invest in assets, leading to a further increase in their prices. People feel wealthy. Therefore, the combination of rising incomes and asset values aids borrowers in maintaining good creditworthiness for long despite accumulating significant debt.

Long term debt peak

This trend cannot be sustained indefinitely and reaches its peak at some point because. Here’s how: Debt burdens gradually rise over the years, leading to bigger debt repayments. At a certain stage, payments toward debts begin to increase at a faster rate than incomes. At this point, people start to reduce their expenditures. As one person’s spending is another person’s income, overall incomes start to decrease. Decreased incomes means people become less creditworthy causing a decrease in borrowing. The ongoing rise in debt repayments makes spending drop even further. This series of events creates a recurring cycle. This situation is the long-term peak in debt. Debt loads have grown excessively large. This was the case for the United States, Europe, and many other parts of the world in 2008. The same phenomenon occurred in Japan in 1989 and in the United States in 1929 for similar reasons.

Conclusion

To grasp the dynamics of the economy, you’ll need to understand the interplay between productivity growth and debt cycles. Productivity growth is a long-term indicator of economic growth, while debt cycles show economic fluctuations. If you monitor these cycles closely, you’ll get valuable insights into the economic trends. These cycles will help you and others navigate the complexities of the financial system. By recognizing the patterns of productivity growth and debt cycles, we can better prepare for the challenges and opportunities that lie ahead in the ever-evolving economic landscape.