My earlier articles introduced the subjects of how money is created by central banks and commercial banks, as well as the idea of currency creation and government debt. This piece will explain both what the debt-based monetary system is and how it works. Get ready to explore the most gripping enigma the world has ever seen which impacts every single being on this planet. Many people have a gut feeling that something is amiss with the global economy, but only a few understand what it truly is.

Don’t worry if you’re not fully understanding how this system deceives people. Not many people do. The system is intentionally complicated. The economist John Maynard Keynes once said that the government can take people’s wealth without them noticing, and only a very small number of people will realize it. However, I believe that with the right presentation, anyone can understand the system, no matter how complex it may seem. Thus, we shall recap what we have already discussed and explain it even simpler.

How the System Operates

A debt-based monetary system comes into being when money is issued as debt. The vast bulk of money within the economy has its origins in loans and is represented by matching domestic debt. The system usually operates in the following steps:

Step 1:

The government issues special IOUs called bonds. These bonds increase our country’s overall debt, and the public is responsible for paying it back. It asks the Treasury to sell these bonds.

Step 2:

The Treasury, the banks and the central bank interchange these bonds are in a sequence of transactions. This process results in the creation of currency. The Treasury sells bonds to banks, who in turn sell this national debt for profit to its central bank. To buy those bonds, the central bank uses a checkbook that has nothing in its account, and then writes checks. The banks receive these checks and magically, currency comes into existence out of thin air. This cycle repeats, leading to an accumulation of bonds at the central bank and currency at the Treasury, which is essentially just a collection of numbers. Eventually, the Treasury deposit the currency to different entities across the government.

Step 3:

The State uses its currency for commitments such as procurement of public infrastructure, welfare programs, military operations or war. The civil servants, contractors and military personnel of government deposit their salaries into commercial banks. Therefore, this money gets back into the banking system through wages, salaries and various payments.

Step 4:

Banks utilize fractional reserve lending to expand the currency supply. They take a large portion of everyone’s deposit and lend it out. When that money is deposited again, they lend a part of it once more, repeating the process multiple times. This action greatly expands the amount of currency in circulation.

Step 5:

We have to pay taxes on the income we earn. These taxes go to the revenue agencies, who then disburse them to the Treasury. The Treasury then uses that money from taxes to service the debt by repaying the principal and interest on bonds held by the central bank, essentially completing the cycle of borrowing and repayment.

Step 6:

The system has become a debt machine where higher rates of debt are required in order to service the ever-growing debt. It relies on a never-ending increase of debts that will ultimately result in its collapse. Despite this, the politicians carefully raise the debt ceiling every time because they do not want the collapse to occur during their tenure.

Step 7:

The big banks own the central banks of the world. These banks profit from selling national debt and receiving interest payments. It sets up a mechanism that works in favor of the rich at the expense of the less affluent. It ultimately redistributes wealth from the poor to the rich, as debt accumulates and interest payments flow back to the banks.

In simple terms, the current monetary framework relies on borrowing currency into existence with the commitment to repay not only the borrowed amount but also additional interest. So, if we borrow the very first dollar into existence and promise to repay it along with another dollar of interest, where do we get that second dollar from? Well, we have to borrow it as well. Unfortunately, the debt load mostly falls on the poor and the lower-middle-class individuals who pay for the loan plus interest which goes back to the banks themselves. It perpetuates a cycle of debt that disproportionately impacts lower-income groups.

In a nutshell, this mechanism transfers wealth from the poor to the rich. It is an eternal and unsustainable wealth cycle that favors the rich at the expense of the present and future well-being of the poor. It’s like a Ponzi scheme because we can never really pay off the debt; it always requires us to get even more into debt.

Impact of this System

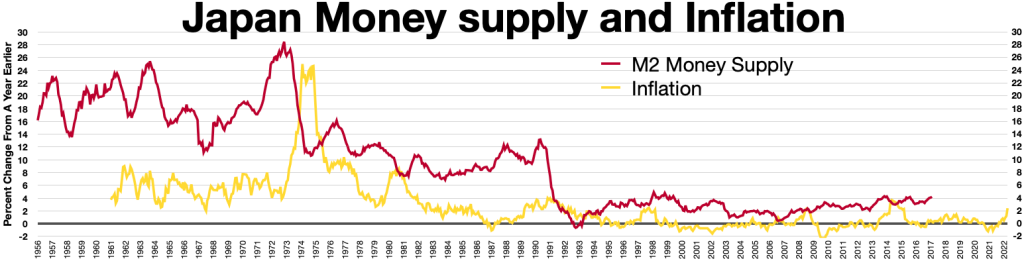

The injection of new funds by the government allows banks to offer more loans to individuals that produce more interest and contribute to the thriving economy. Yet, this also brings more physical currency into circulation, which decreases the value of each unit because there are more units now. Consequently, inflation occurs, causing the prices of goods and services to rise. In turn, people may end up taking loans to make ends meet. Eventually, they will reach a threshold where they can no longer accumulate more debt. Banks then become less inclined to grant credit so readily. Subsequently, the focus shifts from acquiring new debt to settling existing obligations.

The System is a Ponzi Scheme

This behavior shift is rational and reasonable, but on the other hand it also carries risks to the global economy. This is because the global economy has essentially become a large-scale fraudulent scheme. It heavily relies on a perpetual cycle of escalating debt issuance to sustain its operations. If individuals were to strictly adhere to living within their means and using only the existing currency supply, it would lead to a collapse of the system due to the burden of interest payments. Consequently, we are obliged to borrow money into existence so that we could pay interest on the already existing debts. This move leads us into deeper debt. This then results in a constant need to expand the money supply. More currency must be continually borrowed into existence than is repaid through debt settlement to maintain the system’s functionality.

New money reduces the value of existing money. While there the balance in your bank account remains the same, when the government creates new currency without much strong backing, the value of your money reduces. Putting it simply, if you keep your wealth in fiat currencies such as the US dollar, its value will be depreciating all the time. So, no matter how often you check your account balance, the list of goods you can afford will be getting smaller and smaller. Each passing day sees a reduction in purchasing power, emphasizing the erosion of wealth preservation in traditional currency holdings.

Smoke and Mirrors

This system takes away money from the working class and passes it on to the government and banks. The system leads to artificial economic fluctuations (booms and busts) in modern economies and widens the wealth gap between the rich and the working class. It is only made possible because we no longer use real money but instead use currency. However, the worst part is that it is a form of slavery. The word “bondage” comes from the word “bond”. When the government issues a bond, it promises to make us pay the taxes in the future. No one asked for our consent to pay taxes today for the prosperity we experienced in the past. No one is asking our children if they want to work hard in the future to pay for the prosperity we are enjoying now.

The central bank has the power to produce money from nowhere. It doesn’t consider that money should be a representation of real goods and services. What many people fail to understand is that when the central bank does this, it essentially amounts to a hidden form of taxation and confiscation, as Keynes pointed out. By borrowing from the future to fulfill present needs, we bind ourselves and future generations. Since people don’t realize it, politicians and banks can get away with it.

The Illusion of the Debt-Based Monetary System

George Washington once sent a letter to James Madison expressing that it is not fair for any group of people to accumulate debts that cannot be fully repaid within their lifetime. When we borrow money from the future to satisfy our present needs, we are both overburdening ourselves and our children’s and grandchildren’s generations.

The process of bankers creating money is like a remarkable illusion. They have the power to own the earth by controlling credit. Even if you take away their possessions but leave them with the power to create money and control credit, with the flick of a pen, they will create enough money to buy everything back again.

An Alternative System

Printing more money is a short-term fix. Societies and countries should prioritize creating wealth through productive means. The bank should fund sectors that stimulate and promote growth, development, and improvement in the society. Therefore, they should prioritize these areas like small and medium businesses, entrepreneurs, research, education, innovation, manufacturing, etc. Despite the higher risk involved for banks, doing so results in more job opportunities, increased innovation, healthier competition, and improved living standards. Moreover, in the longer run, governments can be in a position to receive higher amount of taxes from the increased incomes without raising taxes. Social programs aimed at assisting those who genuinely require support can utilize these additional tax revenues.

Imagine how different our world would be today if banks had invested hundreds of billions of dollars in ventures like these, rather than in real estate, gambling, predicting price fluctuations, and other risky financial speculations.

While money can be printed, wealth cannot. If we prioritize investing in wealth creation, our economies will be more secure. People and businesses would have more savings to rely on. The key to wealth is by creating value, which is only possible when you are productive and your productivity requires investing your time, effort, and hard work. Had we focused on funding wealth creation, our economies would be more resilient today. Sadly, we now have to face the consequences of a vulnerable system and deal with its effects.

What You Can Do

Every second of every day, the system reduces our wealth and assigns it into the government and the banking system. The current global monetary system was created 300 years ago to benefit a few individuals while disadvantaging the majority. Although this may sound alarming, there is still hope because you are the greatest threat to this dishonest monetary structure. This system thrives on the public’s ignorance about its workings. The people in power do not want you to be aware of this, as it is what has allowed them to remain at the top of the financial hierarchy for the past century.

Citizens are the ones who ultimately can counter the worsening situation of money flow towards central banks and big financial institutions. We all need to accept that currency is just an illusion and holds no tangible value. It is only when we recognize this that we can start to get a clearer vision of achieving financial independence.

The Need to Learn

Currency is like a game that keeps going on. It only holds the value that we assign to it. This understanding will stop us from hoarding wealth in currency. Instead, we should invest it in assets that increase in value more rapidly than inflation. That is the only way to succeed in this game of finance.

The knowledge of this fact will have a life-altering effect as it will influence the decisions we make. If a substantial number of people get to understand this, and it spreads more and more, it could initiate a system change which the world needs to restructure and make better the existing ways of doing things. The impact of this knowledge is profound, offering a pathway to transformation and signaling a way forward amid uncertainty. Although we can do nothing but wait and watch, it is vital to know that there is always a way out of any situation.

Conclusion

The current monetary system is based on borrowing money into existence with the obligation to repay the borrowed amount plus interest, perpetuating a cycle of debt that disproportionately affects lower-income groups, ultimately transferring wealth from the poor to the rich. This system leads to inflation, artificial economic fluctuations, and a widening wealth gap, highlighting the need for a shift towards investing in wealth creation to ensure economic resilience and prosperity for all. Currency is just an illusion and holds no tangible value. It only holds the value that we assign to it.

Recognizing systemic flaws and educating oneself on financial intricacies can lead to transformative choices and, potentially, systemic change. However, the current monetary system is deeply embedded in our society. It is so widespread that we often fail to recognize its presence. When problems arise, we tend to focus on and blame the visible issues—surface problems that seem easy to comprehend. Some individuals attributed these issues to capitalism on a superficial level. However, the root causes are much more complex. However, a closer examination reveals that a complex combination of a debt-based system, excessive financialization, moral hazards, and an unfair distribution of wealth is contributing to a fragile economy and a growing wealth gap. In the next article, we will explore how bankers have significant control over the planet.