Ray Dalio’s free YouTube video “How the Economic Machine Works” is one of the most practical, straightforward, and useful guides to understanding macroeconomics. Dalio used this template to understand the macroeconomic environment for decades, and it contains key ideas such as debt, cycles, deleveraging, and depression. This is one in a series of posts that will break down and simplify his views. This article discusses credit and transactions.

Credit is very useful in an economy. An economy is a system for producing and exchanging valuable goods. The economy is about people: how they make money and for what they spend it. It operates like a simple machine. Many people do not understand or agree on how it works, causing unnecessary economic misery.

While the economy looks complicated in its functions, it operates in a simple and mechanical manner. It consists of a few simple components and millions of transactions which are repeated continuously.

What are transactions?

A transaction is a basic unit of economic activity. An economy is simply the sum of its constituent transactions. Transactions drive all of an economy’s cycles and dynamics. So, understanding transactions allows us to understand the entire economy.

A transaction is a fairly simple concept. When you buy something, you make a transaction. For each particular transaction, a buyer gives money or credit to a seller in exchange for the purchased goods, services, or financial assets.

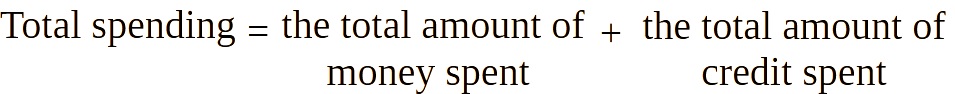

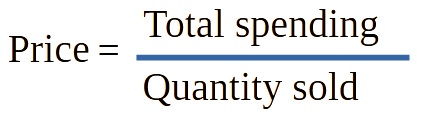

All of the amount of spending fuels the economy. The total spending is calculated by adding the money spent and the amount of credit spent. The price is calculated by dividing the amount spent by the quantity sold.

Transactions are typically carried out in a market. The market is comprised of all buyers together with sellers who trade mainly, the same good. For example, there are markets for cars, stocks, and millions of other goods. An economy is the sum of all the transactions taking place in it in different markets.

Once you add up the total amount of spending and sold amount in all markets, you get all the details necessary to understand the economy. People, businesses, banks, and governments all conduct transactions in the manner outlined above exchanging money and credit for goods, services, and financial assets.

What is credit?

Credit is the ability to buy goods or services without paying for them immediately. However, you have to promise that you will pay for them in the future. Credit is the most crucial aspect of the economy, although it is perhaps the least understood. It is the most crucial because it is the largest and most unpredictable element.

Any two persons can decide to produce credit out of thin air! When borrowers commit to repay and lenders believe them, credit is created. Credit differs from money. You use money to settle transactions. When you buy a beer from a bartender with cash, that transaction gets completed on the spot. In comparison, when you buy a beer on credit, you’re stating you’ll pay in the future. You and the bartender generate both an asset and a liability. You have just created credit. Out of thin air. The bartender has credited you a bear, while you have the liability to pay it. It is not until you pay the bar tab that the asset and liability disappear, the debt disappears, and the transaction is complete.

Why do we need credit?

Credit helps lenders and borrowers achieve what they want. Lenders typically want to turn their money into more money, whereas borrowers usually want to buy something they cannot afford, such as a home or a car, or to invest in something, such as starting a business. Borrowers commit to repay the amount borrowed, known as the principal, plus interest.

Credit is difficult to understand since it goes under many different names. When credit is established, it quickly converts into debt. Debt is both an asset to the lender and a liability for the borrower. When the borrower repays the loan plus interest, the asset and liability evaporate, and the transaction is completed.

The government is the largest buyer and seller. It consists of two major components: a Central Government that collects taxes and spends money, and a Central Bank, which regulates the amount of money and credit in the economy. It accomplishes this by changing interest rates and issuing new money. For these reasons, the central bank plays an important part in the flow of credit. When interest rates are high, people borrow less since it is more expensive. When interest rates are low, loans are cheaper so, people borrow more.

Why is credit so important?

Because when a borrower obtains credit, he may increase his expenditures. Remember that spending drives the economy. This is because one person’s expenditure equals another’s earnings. Consider this: every dollar you spend generates income for someone else. Every income you make has already been spent by someone else. So, when you spend more, someone else earns more. When someone’s salary rises, lenders are more inclined to lend to him since he is now deemed more creditworthy. A creditworthy borrower has two characteristics: the ability to pay back a loan and collateral. Having a high income in relation to his debt allows him to repay. If he is unable to repay, he has significant assets that can be used as collateral and that can be sold.

This makes lenders feel more comfortable lending him money. So higher income allows for more borrowing, which leads to more expenditure. And because one person’s spending equals another person’s income, this leads to further borrowing, and so on.

Let me give you an example. Assume you make $10,000 per year and have no debts. You are creditworthy enough to borrow $1,000 on a credit card, allowing you to spend $11,000 despite earning only $10,000. Someone else earns $11,000 as a result of your spending. The guy earning $11,000 with no debt can borrow $1,100, allowing him to spend $12,100 although earning just $11,000. His spending equals another person’s income, and by analyzing the transactions, we can observe how this loop reinforces itself. This self-reinforcing process promotes growth in the economy.

These interactions, as discussed above, are primarily motivated by human nature, and they generate three major factors that power the economy.

- Productivity growth

- The Short-term Debt Cycle

- The Long-Term Debt Cycle

Conclusion

The economy works as a simple yet complex system driven by transactions. When you understand the basic concept of transactions, you’ll understand how the entire economy operates. Transactions take place in different markets. They involve exchanging money or credit for goods, services, or financial assets. Credit is an important part of the economy. It allows borrowers to spend more and helps boost economic growth. The government, through the Central Bank, also plays a significant role in controlling the flow of credit by affecting interest rates and money supply. Ultimately, the economy is affected by human behavior. Try to understand these basic ideas, you will get a better grasp of how economic processes work.