Budgeting is the art of creating a budget. a budget is an instrument of managing money. It is used as an aid in planning, programming and control of your activities in relation to money. In short, a budget is a statement showing the way a you plan to spend your money and where that money will come from.

Why do you need a budget?

A budget shows you:

- how much money you make

- how you spend your money

- whether you will have enouagh money to do activities you wish to

Why do I want a budget?

A budget helps you:

- decide what you must spend your money on

- make sure that you have enough money to cover your expenses every month or year.

- decide if you can spend less money on some things and more money on other things

- make savings towards goals or emergencies.

Steps to Create a Budget

1. Assess your current financial situation.

Get together all your financial information which includes bank statements, bills and records of all historical expense to assist you in knowing your current financial situation. These documents will aide you to detail your current monthly or yearly income and the expenses to help you plan your finances for the future.

2. Set clear financial goals.

Your need to identify what do you want to accomplish with your budget. You may, for instance, want to put money aside for a down payment on a home, pay off your university loans or create an emergency fund. Set definitive goals so that you are able to stay on track.

3. Sort Your Expenses

Categorize your expenses into distinct categories. They could be housing, transportation, groceries, utilities, entertainment, and savings. This arrangement provides a platform, where you can clearly visualize your spending and, therefore, manage your finances more effectively.

4. Determine Fixed vs. Variable Expenses

All expenses are not equal. Fixed costs, for instance, rent or mortgage, normally do not change from one month to another. However, the discretionary costs, such as entertainment, can be variable.

5. Allocate funds to each category.

In each category, allocate a specific sum based on your income and expenses. Be a realist and provide for the necessities, savings and discretionary spending.

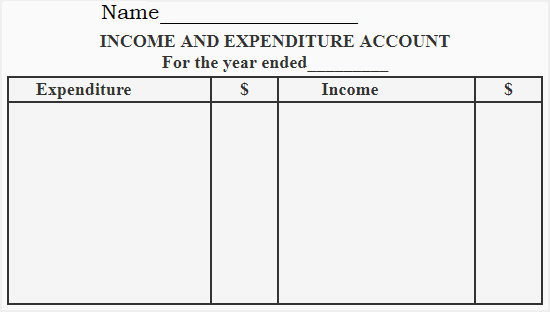

6. Create a budget.

Use pen and paper, a spreadsheet, or a budgeting app, and start creating your budget. Record your allocations for each category.

7. Monitor and adjust

Paying close attention to your expenditures and checking them against your budget on a regular basis. This aids you to quickly know whether you are really doing well on your financial plan or if you have to make some adjustments.

8. Focus on your financial goals.

your budget should serve as your compass in attaining your dreams. Buying your own home, or becoming debt free are some of the things you aimed to achieve. Keep yourself motivated and disciplined as you go through this process.

Tips for Successful Budgeting

- Prioritize needs over wants.

The primary elements of your budget that must be met are food, shelter, utilities, and transport. So, you must allocate funds for them. Dining outside or electronics are non-essential things which you should only buy after meeting your needs. - Cut unnecessary expenses.

When analyzing your budget, find cheaper options for your daily expenses. Moreover, choose what to spend less on like dine out less frequently or get rid of your multiple subscriptions. - Negotiate and seek better deals.

Bargain with utility service providers that provide internet services, utilities, insurance, or loans to get lower rates. Negotiate with service providers such as cable and internet providers to obtain better rates on utilities, insurance, or loans. - Save for the Emergencies and Long-Term Goal

You should put some money in your budget for emergency savings. These funds will shield you against unplanned expenditures. In addition, save money towards your financial goals such as buying a car. - Seek professional advice if needed.

Financial advisers, credit counselors, and debt management programs will provide you with budgeting solutions specific to your situation or goals. - Bring your own family or roommates into the picture.

Incorporate your family members and roommates in the budgeting process. With that move, it is assured that everyone will be in agreement and are working together for the same purpose.

Tools and Resources for Effective Budgeting

There are many budgeting tools and resources that you can use:

- Budgeting Apps

These apps come with options like budget tracker, goal targeting, and smart categorization for expenses. Mint, YNAB, Personal Capital, and PocketGuard are all popular apps. - Online Budgeting Tools

There are several budgeting tools and calculators available for for you to use for free on websites like NerdWallet and Bankrate. - Spreadsheets

You can make Excel or Google Sheets personalized tools to suit your own needs. - Books on Personal Finance

There are many books on budgeting. One example is Dave Ramsey’s “The Total Money Makeover” and Vicki Robin and Joe Dominguez’s “Your Money or Your Life”. - Podcasts and blogsblogs

Explore finance podcasts and blog posts which give practical advice on budgeting and personal finance management. Popular ones include “The Dave Ramsey Show” and “The Simple Dollar”. - Community and Forums

Various online discussion groups and websites, such as Reddit, are a good source of that kind of information. They offer useful budgeting advice, tips, help, support, insights and viewpoints.

Ultimately, select the budgeting tool (or tools) that is best suited to your financial goals, lifestyle and personal choice.

Conclusion

Being able to budget effectively is a skill that you should work on to manage your finances properly. Implement the budgeting process that was provided. You will get a concrete idea about your finances, set easy to achieve targets, classify your expenses, and budget appropriately.

Prioritize what you need instead of what you want and live without unnecessary things. Create an emergency fund for when you need it. These techniques however are the core ingredients for a successful budgeting journey.

Supplement your budgeting skills with the use of a budget app and online resources, spreadsheets, books on personal financial management, podcasts, and community forums. Stay disciplined with your money, and keep your eyes on the prize: your financial goals. Discipline is what will bring you more stable financial future.